Exploring Exit Opportunity for a Portfolio Company

Situation

- Our client a US-based family office, looking to exit one of its largest portfolio companies.

- The client wanted JMI to analyze various strategic options and search for a potential buyer.

JMI Implementation

- Conducted detailed research on company and valued the company using SOTP method and company comparable.

- Valued 37% of investor’s equity value at $65M and also identified the realized gain of $61M during 19-year holding period.

- Assessed that the company has one of its best investment in portfolio with MoIC of 32.6x and IRR of 39.2%.

- Based on analysis done, JMI team identified that the size of market remains a constraint for further growth potential and that company had reached its maturity in their strategic frames.

- JMI recommended two options:

| Options. | Potential Actions. | Pros. | Cons. |

|---|---|---|---|

| Option 1: STAY / SEEK GROWTH |

|

|

|

| Option 2: EXIT / SEEK LIQUIDITY |

|

|

|

Value Delivered

- The JMI Team performed sectoral research to provide insights on sector trends and outlook.

- JMI conducted SOTP valuation of company to get insights on return on invested capital.

- JMI team recommended two options and potential actions to take based on the selected option.

- JMI assisted the client in their exit decision of the investment and found two potential buyer.

For More Information and Details

Reach Out to Us NowInvestment Screening

Situation

JMI worked closely with senior team members in creating an entry strategy for European Markets.

- Phase I - Construct a comprehensive database of all mid and large-cap companies across sectors.

- Phase II - Create multiple filters to shorten the focus on particular sectors and companies.

JMI Implementation

- Began the search by classifying 10,000+ companies.

- Acquired the data list from multiple sources such as Bloomberg, industry associations, and trade journals.

- Filtered and cleaned the list down to 500 companies based on size and profitability.

- As per client’s request, focused on 5 industry segments to understand the dynamics.

- Profiled 66 companies with a special focus on management and their affiliations, company financials, operations, and valuation ratios.

Value Delivered

- Submitted a comprehensive database of all mid and large-sized European corporates.

- Profiled identified companies on key operating and performance metrics.

- JMI also organized management meetings with 15 European companies shortlisted based on company’s analysis.

For More Information and Details

Reach Out to Us NowExit / Realize Value

Situation

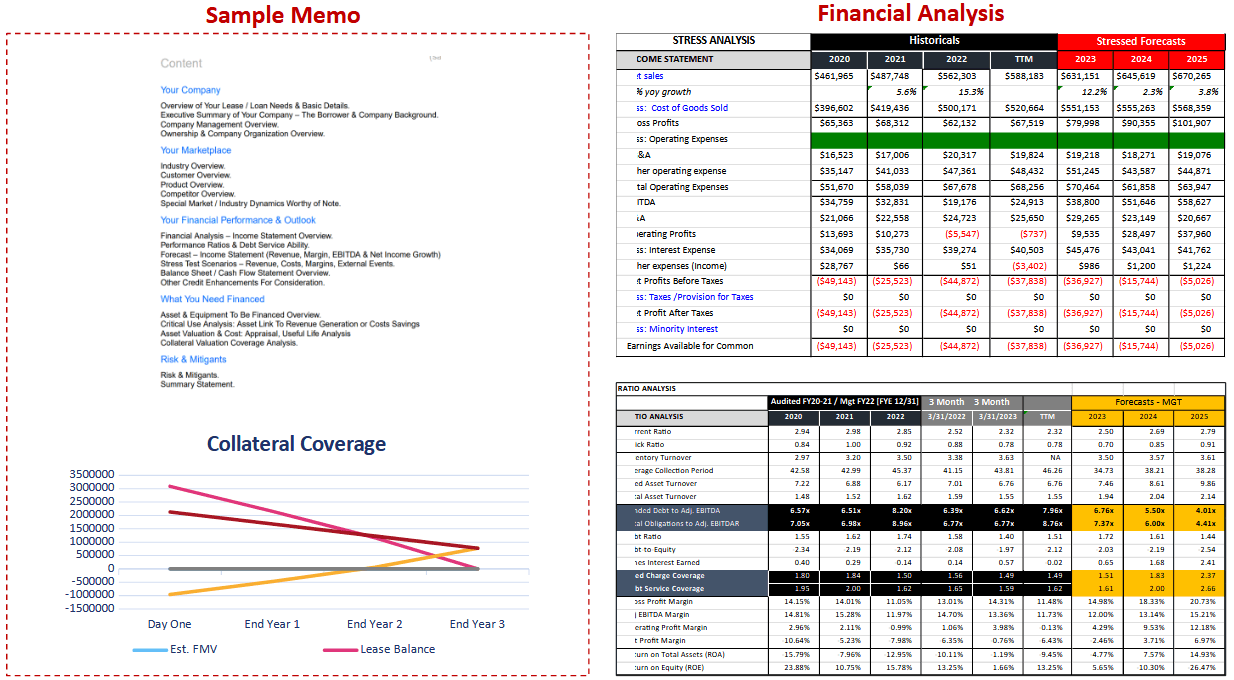

- Our client, a mid-market PE firm, requested to help Partners in analyzing exit valuation for their renewable energy portfolio company.

- They also wanted us to outline the specifics to be reviewed for the valuation exercise, including details of the portfolio company.

JMI Implementation

- Performed screening for public and private entities in the renewable energy space and compiled a list based on their offerings.

- Filtered and reviewed renewable energy companies with a detailed analysis and history of all private equity investments and acquisitions in the sector.

- Computed their current and forward trading multiples and arrived at a range of exit multiples.

- Provided the range of valuation multiples based on the analysis and helped identify KPI enabling premium valuation.

Value Delivered

- Provided a detailed review and synopsis of deals and exit valuations within the US renewable energy space and the exit valuation range.

- Created a deal enhancer document emphasizing the strategic advantage of the portfolio company.

- Created a list of potential strategic competitors, value chain etc. and financial buyers (sale to another PE fund) for the portfolio company.

- Helped the PE firm take an informed decision with regard to exit opportunities, enabling them to realize optimum return on investment.

For More Information and Details

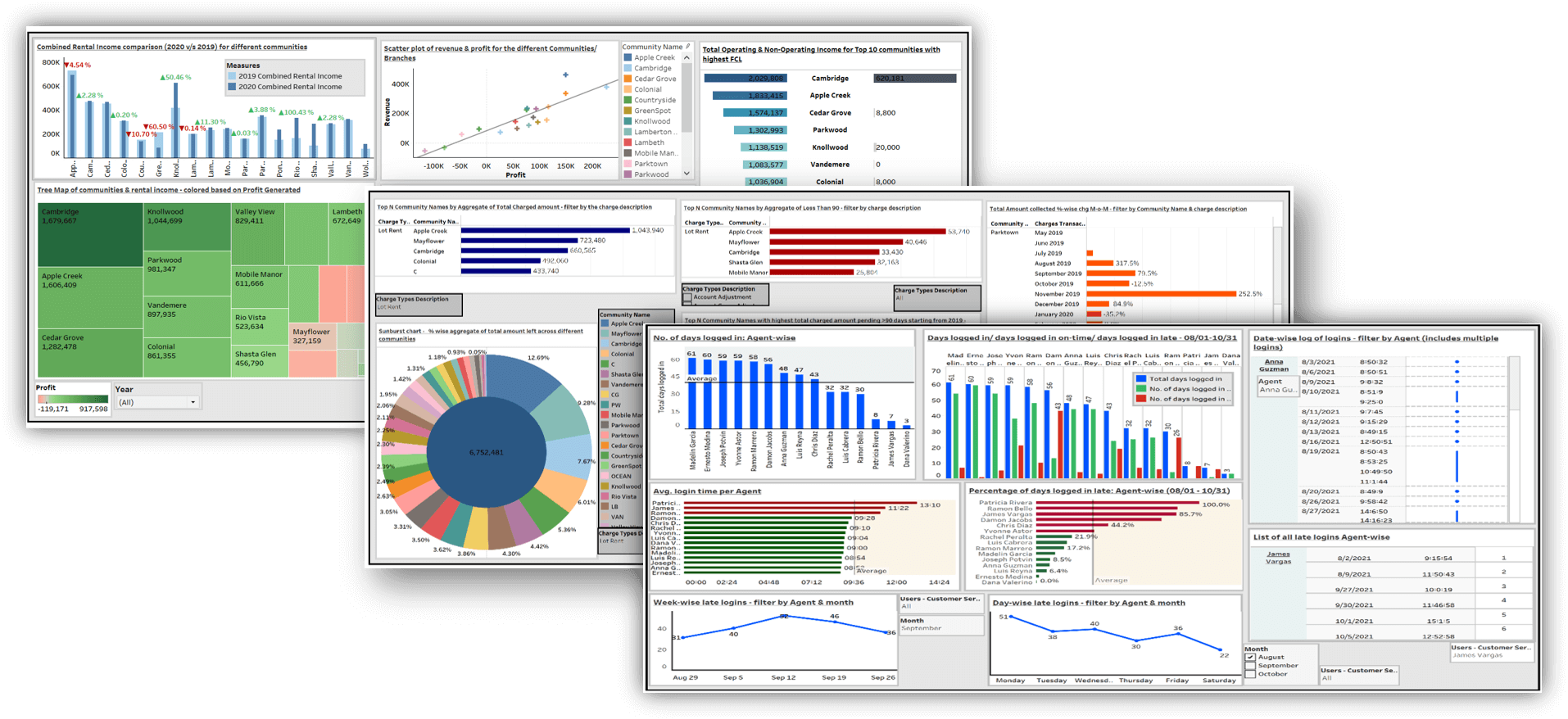

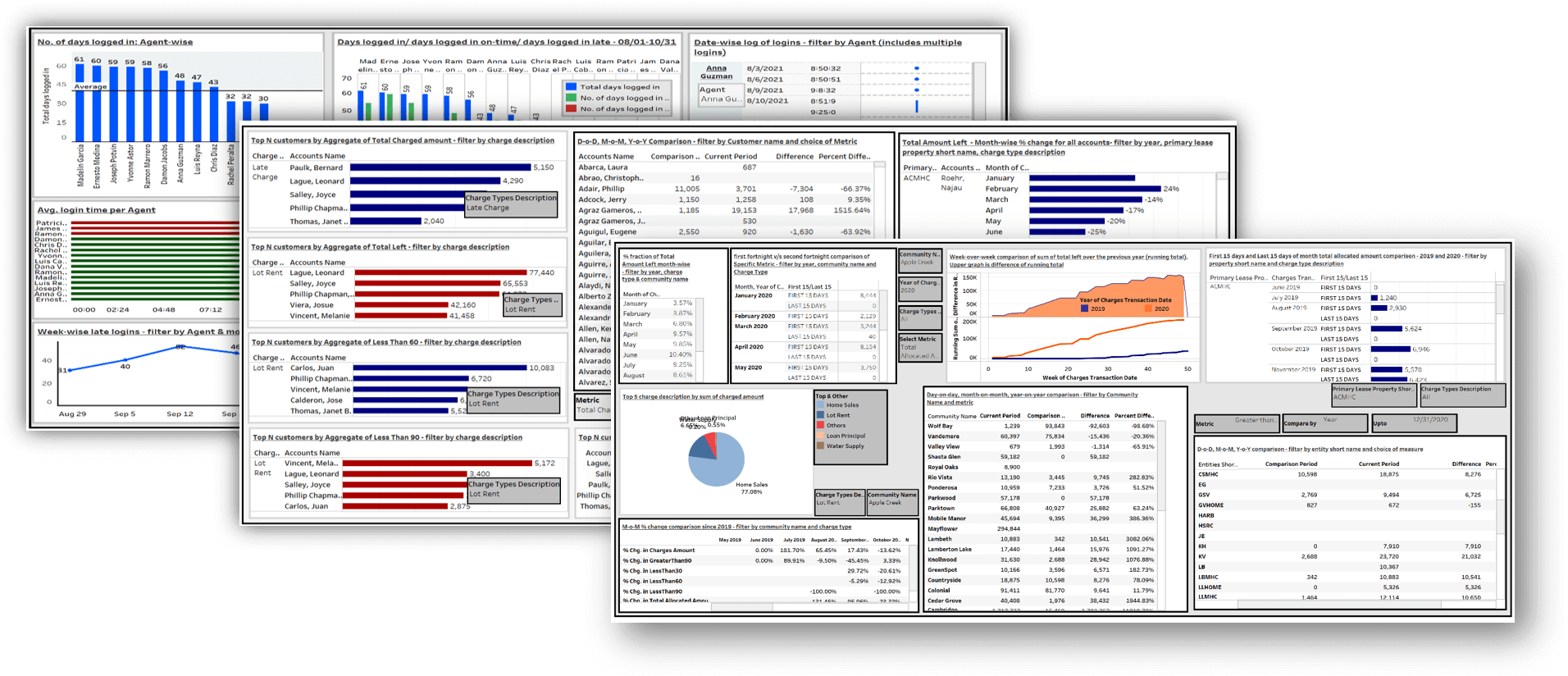

Reach Out to Us NowMonitoring and Improving Portfolio Performance

Situation

A Middle Market Private Equity Firm.

Help monitor and improve portfolio companies’ performance by uncovering business insights within ERP (Enterprise Resource Planning) systems.

Solution

JMI’s solution comprised of the following approach:

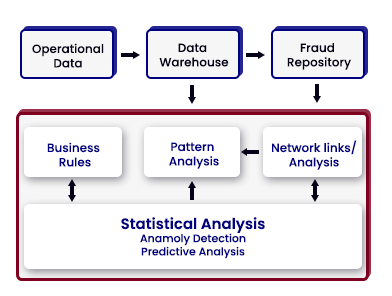

- Operational level data: Extracted operational level data such as sales statistics, inventory levels, ordering/purchasing data, working capital metrics, customer acquisition costs, and other KPIs for high-level scrutiny of portfolio companies.

- Mapping with the current trends: Operational level data of portfolio companies was dissected further and benchmarked with the latest trends and developments to gain deeper operational insights.

- Creating value: This lead to the identification of a specific focus areas for each portfolio company along with data insights on revenue and costs. Insights across the portfolio companies further assisted the PE firm to implement best practice of one portfolio company to all others leading to improvement in the overall portfolio.

Value Addition

- This helped the PE firm in guiding the portfolio company to bring operational efficiency and identify growth opportunities.

- Analytical benchmarking exercise assisted portfolio company to align with recent and upcoming trends.

- Data-backed focused insights improved the growth trajectory for portfolio companies.

For More Information and Details

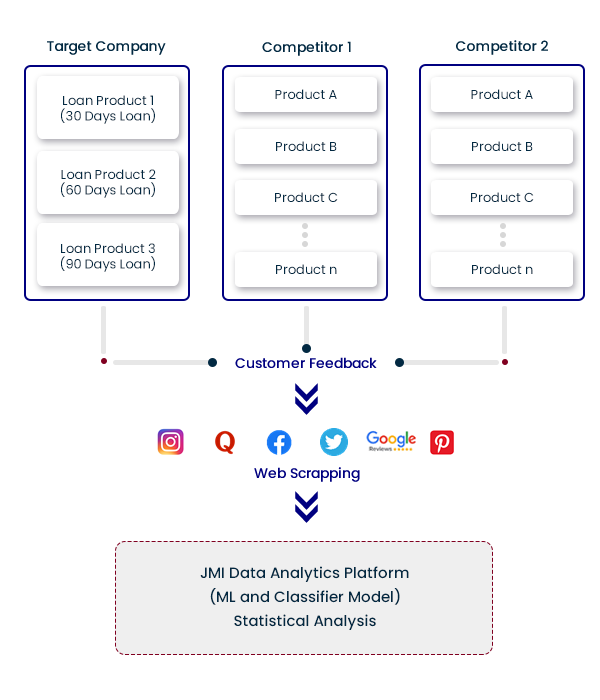

Reach Out to Us NowInvestment Research & Due Diligence using AI

INTRODUCTION

A mid-market private equity fund wanted to invest in a US-based digital lending fintech company. Historically, the PE fund relied upon traditional, manual, and defensive methods of due diligence. The fund wanted to get deeper data-driven due diligence insights on the company’s products, market positioning, customer beliefs, and organizational culture. JMI's data analytics team was roped in to leverage the JMI data analytics platform to get actionable insights on four broad areas, which included:

- Product Reviews: We scraped the data from community websites, aggregated internal KPIs, and used machine learning techniques to construct deep learning to curate sentiments on trends and key imperatives.

- Customer Lifetime Value: Used a probabilistic model to predict the future count of the transaction and its monetary value for each customer, potential churns, and primary market drivers that could improve top-line growth.

- Customer Acquisition Cost: Analyzed customer-level data to observe the acquisition cost across different channels and regions with diverse demographic compositions across market segments.

- Organizational Culture: Deployed a dashboard that provides insights on company attrition rate and analysis based on employee experience, gender, educational background, etc. Also, the web scrapped data from review websites to get insights on employees' beliefs about company culture.

JMI's proprietary models and data aggregation platform produced unique and powerful insights on business revenue and margin performances based on raw transaction-level data along with core business capabilities and market drivers such as production capacity, sales and distribution KPIs, cash flow, and potential trends in the competitive market, etc.

The JMI data analytics platform set up during diligence for investment evaluation was further extended to capture the company’s everyday business intelligence in order to retain the key insights and data sources that underpinned the deal thesis and value creation plan over the investment cycle.

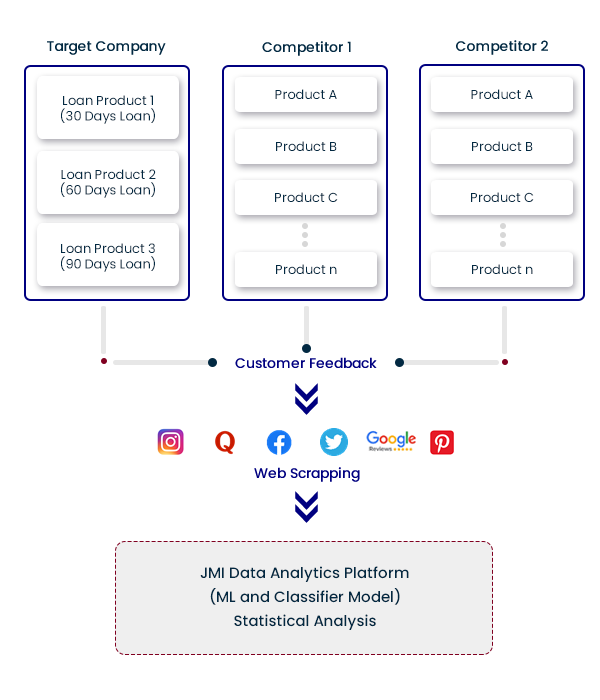

Objective 1: Customers’ Perception of Company Products

The PE fund wanted to understand the customers’ perceptions of the various company products and their competitive positioning in the market. They specifically wanted to leverage the JMI data analytics platform to gain deeper insights into customer views for various products using social networking websites and understand product positioning relative to competitors.

JMI Implementation

Step 1: Data Ingestion

- Extracted data from the company webpage or community sites on customer reviews, which typically contain a comment, rating, usefulness, and username.

- Web scraped data from other sources that included Google reviews, Facebook, Quora, Pinterest and Twitter.

- Aggregated key business performance data to gain first-hand information on the health of the products.

Step 2: Data Pre-Processing

- Converted the unstructured data extracted from different sources into structured formats.

- Applied stemming to reduce the size of the vocabulary, remove the junk words and extract the key signals.

Step 3: Train Datasets & Build Models

- Build hybrid models combining lexicon analysis and Machine Learning Techniques.

- Used machine learning techniques to train the dataset and construct a classifier model that can identify text that expresses sentiments and patterns.

- Classified and scored the text based on positive, negative, and neutral expressions.

- Derived predictive insights on specific trends and affinity scores to access the future potential.

Step 4: Evaluation

- Ran the model with the extracted dataset on different products and analyzed the pattern.

- Used evaluation metrics such as Precision, Recall, F-Score, etc. to compare the product with competitor companies and understand its market positioning.

Step 5: Provide Insights

- Identified that 58% of customers were using a Loan Product of 60 days with 98% repayment.

- 74% of customers had positive reviews of its products and customer service, and 30% of new applicants faced difficulties with initial onboarding.

- Identified that its products were uniquely positioned to acquire novice customers relative to its competitors.

- Found that only 9% of customers opted for a 90-day loan product and had high NPAs.

Insights

- Customer Perception on each loan product.

- Areas with negative reviews and needs improvement.

- Product Positioning relative to competitor.

- Product Performance.

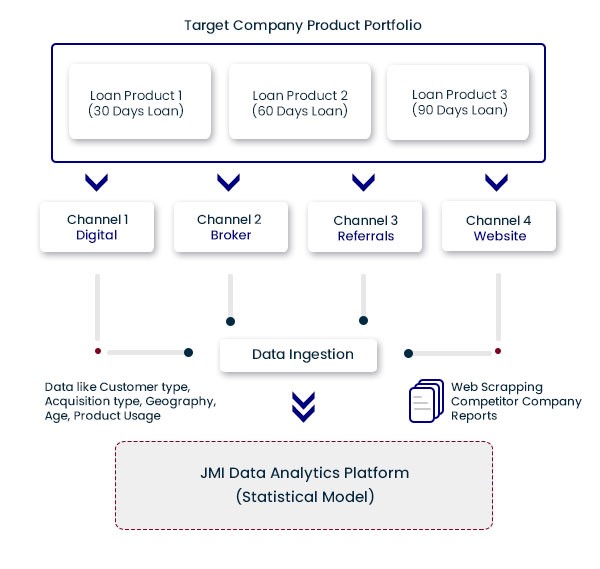

Objective 2: Due Diligence on Customer Acquisition Cost for the target company

JMI analyzed the cost of customer acquisition across different marketing channels of the fintech company and provided specific insights on

- Marketing-mix across different channels with geographies and age groups.

- Quantify the Customer Acquisition Cost (CAC) and benchmark it with competitor companies.

JMI Implementation

Step 1: Data Ingestion

- Ingested the large volume of data for the last 5 years on each product from different marketing channels and aggregated this into the JMI platform.

- Scanned reports of competitor companies on keywords like customer acquisition cost, marketing spends, marketing mix etc.

Step 2: Data Cleaning

- JMI team cleaned the data and ensured that it was in a usable form and did not carry any discrepancies.

Step 3: Data Analysis

- Using high-performance ML models, JMI performed a multi-variate analysis to link the CAC with different marketing mix, age group and region.

- JMI team also benchmarked the CAC extracted through web scrapped reports of competitor companies to get insights on the actual CAC of the industry.

Step 4: Provide Insights

- JMI team identified that the CAC for the target company was 26% higher compared to the average CAC of the industry.

- Observed that digital channel was not efficient and had a high turnaround time.

- 70% of customer acquisition was through broker channels and the cost associated with it was 30% higher than digital channel and 20% higher compared to industry average.

Step 5: Cost Optimization Strategy

- JMI suggested that the company can efficiently manage its marketing expense if they focus on acquiring customers through a digital channel within the age group of 25 to 32 years and in Tier 1 cities.

Insights

- Customer acquisition cost on different channels.

- Benchmarking CAC with competitor companies.

- Right marketing mix for cost optimization.

- Designing Marketing Campaign for efficient customer acquisition.

Objective 3: Customer Lifetime Value (CLTV) Modeling

The client wanted to understand the potential contributions made by a customer to the company’s revenue across the years to estimate the customer lifetime value and gain deeper insights on optimal customer mix which could contribute to higher revenues in the future.

JMI Implementation

Step 1: Data Ingestion

- Aggregated the customer and transaction data for the last 5 years.

- Distributed data into a quarterly transaction done by each customer.

- Scanned reports of competitor companies on keywords like churn rate, CLTV etc.

Step 2: Data Cleaning

- Removed missing values and inconsistencies in the upper- and lower-case data.

- Removed duplicate categorization and streamlined the data.

Step 3: Probabilistic Model

- Deployed statistical methods to model the probability distribution.

- Using Probabilistic models using statistical and AI techniques, the future count of the transaction and monetary value of the transaction was estimated.

- Correlated the company CLTV with competitor companies.

Step 4: Provide Insights

- Identified that Tier-1 city customers had higher lifetime value and 70% of them were recurring.

- Found that customers with an age range between 25-30 years had higher contribution i.e., 35% of revenue and 63% of them were frequent users.

- Identified that CLTV for the target company was in line with the industry average.

- Predicted the churn rate of c.17% annually.

Step 5: Cost Optimization Strategy

- JMI team analyzed that customer acquisition cost had a major impact on CLTV.

- JMI team suggested the PE client to lower the CAC and focus on acquiring customers within the age group of 25 - 30 years through digital channel.

Insights

- Contribution of each customer on revenue.

- Monetary value and future count of transaction.

- Churn rate.

- Predict CLTV with customer type, region and product.

- Potential impact on KPIs to access business performance in both short and long term.

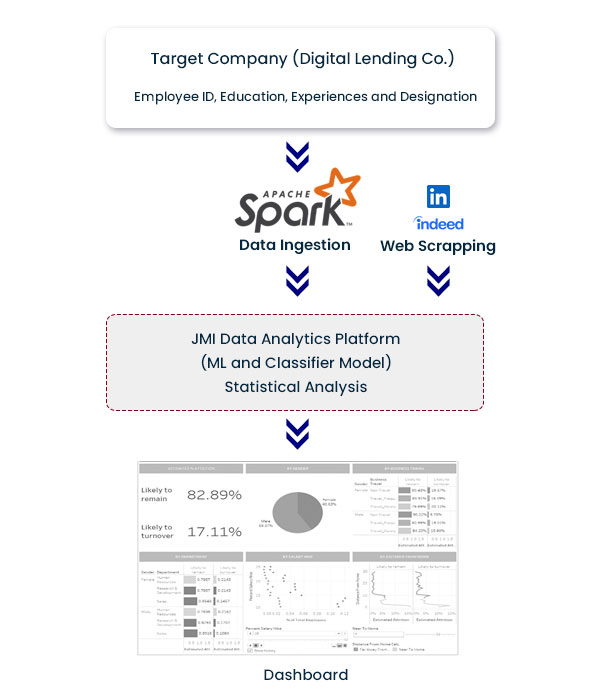

Objective 4: Understanding Organization’s Culture

The PE fund was facing difficulties in getting insights into the organization’s culture. They wanted to get a clear picture on employee beliefs towards the target company and predict employee attrition rate. They further wanted to analyze the correlation between attrition rate vs employee experience, salary and education background, etc.

JMI Implementation

Step 1: Data Gathering and Ingestion

- Gathered data of employees from company MIS.

- Web scrapped data on employees’ reviews from LinkedIn, Glassdoor, Indeed and other sources.

Step 2: Data Pre-Processing

- Classified the data on employees with employee id, designation, education and experience.

- Removed the anomalies, punctuations, and junk words from scrapped data.

Step 3: Build ML Model

- Used machine learning technique to train the dataset and construct classifier model that can identify text that expresses sentiments.

- Classified and scored the employee reviews based on positive, negative and neutral sentiments.

Step 4: Data Analysis

- Used AI techniques on employees’ data to get insights on the talent pool.

- Analyzed the correlation between attrition rate vs overtime, experience and salary.

Step 5: Dashboard for Visualization

- Connected BI dashboards to the dataset and created a dashboard.

- Dashboard included analysis on percentage of predicted attrition, analysis by gender, business travel, department and salary hike etc.

Step 5: Provide Insights

- Predicted attrition rate of c.17%

- Out of 17% of turnover, 40% of employees wanted to leave because of low salary.

- Employee mix constituted 70% from finance background and 20% with engineering background.

- 65% of employees were male within 3 years of work experience.

Insights

- Attrition rate and reason for attrition.

- Employee mix based on gender, designation, experience and education.

- Employee beliefs on company culture.

For More Information and Details

Reach Out to Us NowSupply Chain Optimization

Problem Statement

- Our client is a leading US-based Private Equity firm, wanted us to smoothen inventory management for a portfolio company that manufactures automobile parts and have operating centers at more than 250 location.

- The company wanted their spare parts to reach customers on time always.

JMI Implementation

- Extracted the historical data and analyzed various data like shipment order type, from - to details etc. to design daily warehouse stock and inventory reporting tool for warehouse managers. This gives them a comprehensive overview of the level and location of stock, and shows recommendations on where to store each item based on customer demand.

- Analytics team also extracted three years of historical shipping data to predict the number of outbound and inbound shipping orders per warehouse over daily, weekly and monthly horizons. It helped the company to manage their labor planning and maintain the right level of staffing to deal with customer demand on any given day.

- Observed that during the during summer holidays in US, there was a spike in demand for automobile parts and which required a huge workforce for better supply chain management.

- Built an optimization model for their client which helped them to solve complex distribution network problems and provided optimal solutions within a given set of parameters. JMI team also observed that 8 of its distribution center had lower sales compared to average sales figures because of longer deliverable time.

- Provided insights to clients for better positioning of its warehouses to minimize delivery time and costs across the entire network.

Results

- JMI designed smarter distribution networks that optimize speed and costs.

- JMI helped the company to improve inventory movement thereby reducing labor cost and increasing revenue.

- C.99% of warehouse packing tasks are error free.

For More Information and Details

Reach Out to Us NowDemand Forecasting

Problem Statement

- Our client, a US-based private equity firm, wanted us to analyze sales data for a portfolio company in the retail sector.

- The current planning process for promotional and non-promotional seasons relies heavily on old, classical business rules developed over time. There was a need to realign these rules with current market trends and develop predictive models in order to have a robust demand forecasting process that accurately accounts for promotional impact.

JMI Implementation

- JMI Collected sales and promotional data across stores and blended them to have a uniform item-by-store-by-day level of granularity.

- Standardized data is obtained by pre-processing data to de-trend, de-seasonalize, and remove holiday effects.

- Built forecast models for baseline and promotional estimations, using a combination of time series and a frequency-based approach.

- Modelled separately for regional Black Friday-type promotional events and identify the most selling and profitable categories.

- Used store-level daily sales distribution indices to break down weekly to daily sales.

- Identified similar products for new products by clustering for 10+ features (like sales, regional preference, complement, substitute, promoted group, etc.) and modelling based on them.

- Automated the end-to-end process and enabled calibration for daily or weekly updates.

Results

- Our forecasting models assisted the retailer in generating items, store, and day-level forecast accuracy improvements ranging from 5% to 60%, with a weighted average improvement of around 20%.

- Estimated business value due to stock-out avoidance and improved product mix was around a 1.5% to 2% net increase in overall sales.

For More Information and Details

Reach Out to Us NowCustomer Segmentation & Cross-Selling

Situation

A large private equity fund whose 30% of portfolio comprised of e-commerce companies reached out to JMI to leverage its data analytics capabilities to identify actionable insights to increase gross sales for portfolio companies. Its specific briefs were to:

- Identify the customer segments for selling the best product mix in specific geographies.

- Forecast revenues with the recommended product mix (from above analysis) based on demand trends.

JMI Implementation

- Collected large amount of customer data of its e-commerce portfolio companies from a range of data sources such as transactional/purchase data, demographic data, customer interactions etc.

- Used JMI proprietary similarity metrics with clustering techniques and decision tree to define top segments based on customer characters, geo-factors, market trends, macro-economic factors and others.

- Identified that two of its e-commerce companies have lower market penetration in top tier cities which has a high impact on its top line revenue.

- Used classification methods to score the degree of customer’s propensity for purchasing particular products of each company based on historical data obtained from the targeted market segments.

- Implemented time-series and artificial neural networks to predict revenue that is likely to result from newly identified segments and conducted back-testing using historical marketing data for validating the hypothesis.

- Cross-validated data and model accuracy using partitioned data and prebuilt ML/ AI models.

Value Delivered

- Provided insights on targeting the most significant customer segments in the specific markets.

- Classified the right product mix based on customer types and their preferences.

- Increased QoQ revenue by c.2-4% for all its e-commerce companies.

- Reduced revenue forecasting errors for initial quarters by c.15%

For More Information and Details

Reach Out to Us NowDeal Origination

Situation

- Our client, a private equity firm that investments in early stage growth companies wanted to adopt a data driven deal origination process.

- The client wanted to build a platform to identify potential targets for deal origination based on specific criteria and investment strategies.

JMI Implementation

JMI’s solution comprised of the following three-phased approach:

- Data Extraction: Extracting data through web scrapping tool based on specific criteria such as company brand value, customer sentiment, product portfolio, social media posts, customer review, management team and other unstructured data.

- Predictive Analytics: By looking at relevant data patterns and trends, model can conduct early detection of the companies with high growth opportunities and decide whether it’s an opportunity worth pursuing or not.

- Deal Sourcing: JMI also helped the PE firm to identify the target companies & assisted in engaging company management.

Results

- Increase in deal origination: 30%

- Savings in overall processing time: 40%

For More Information and Details

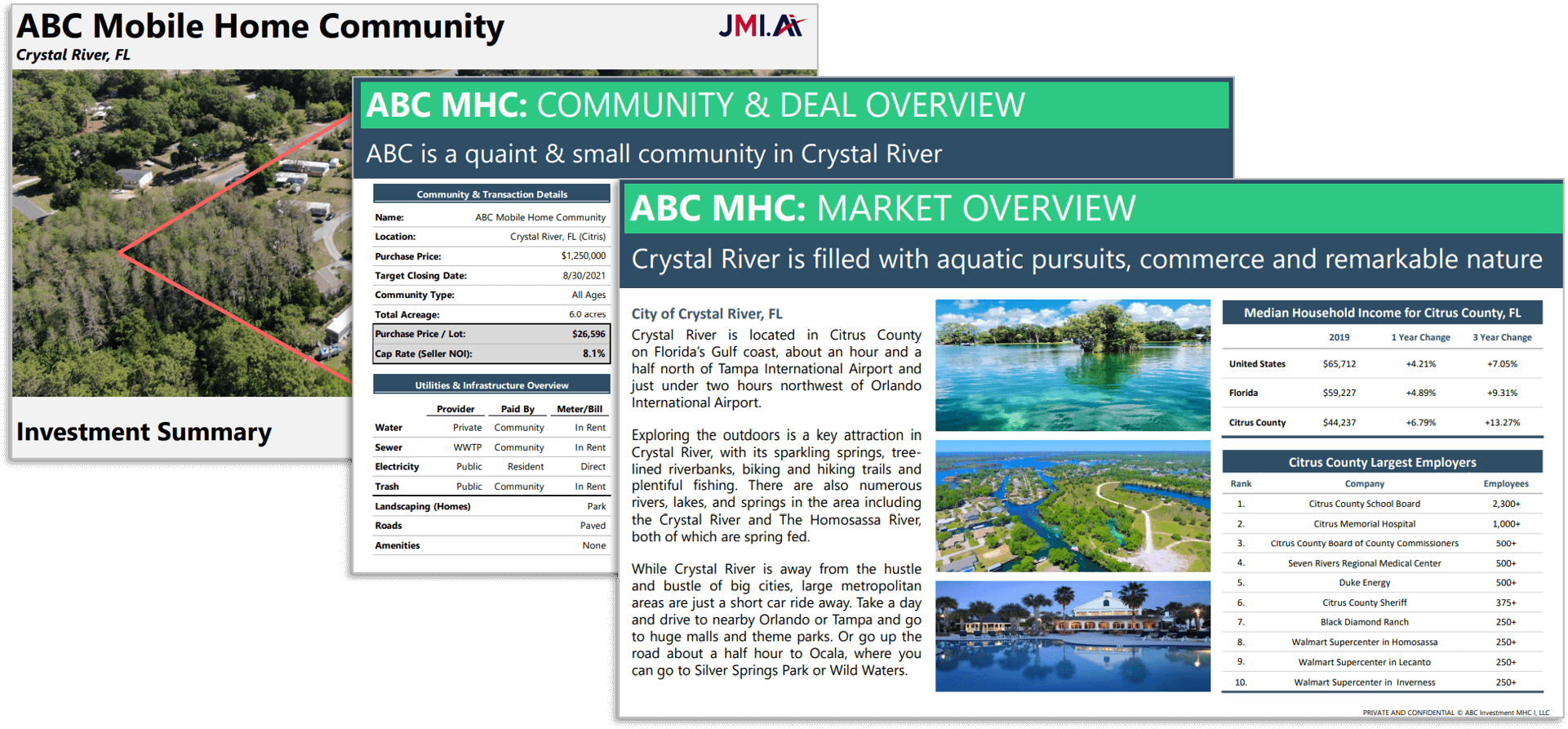

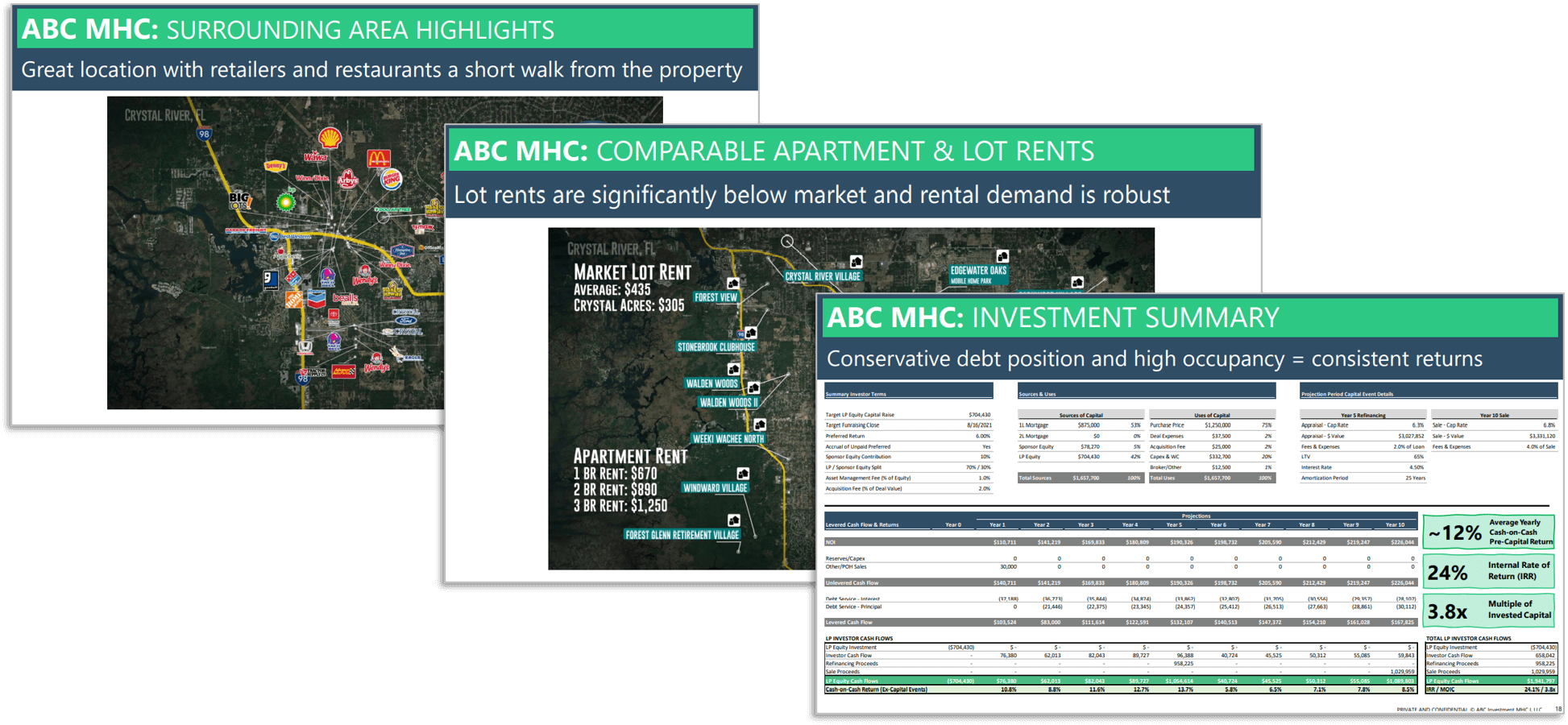

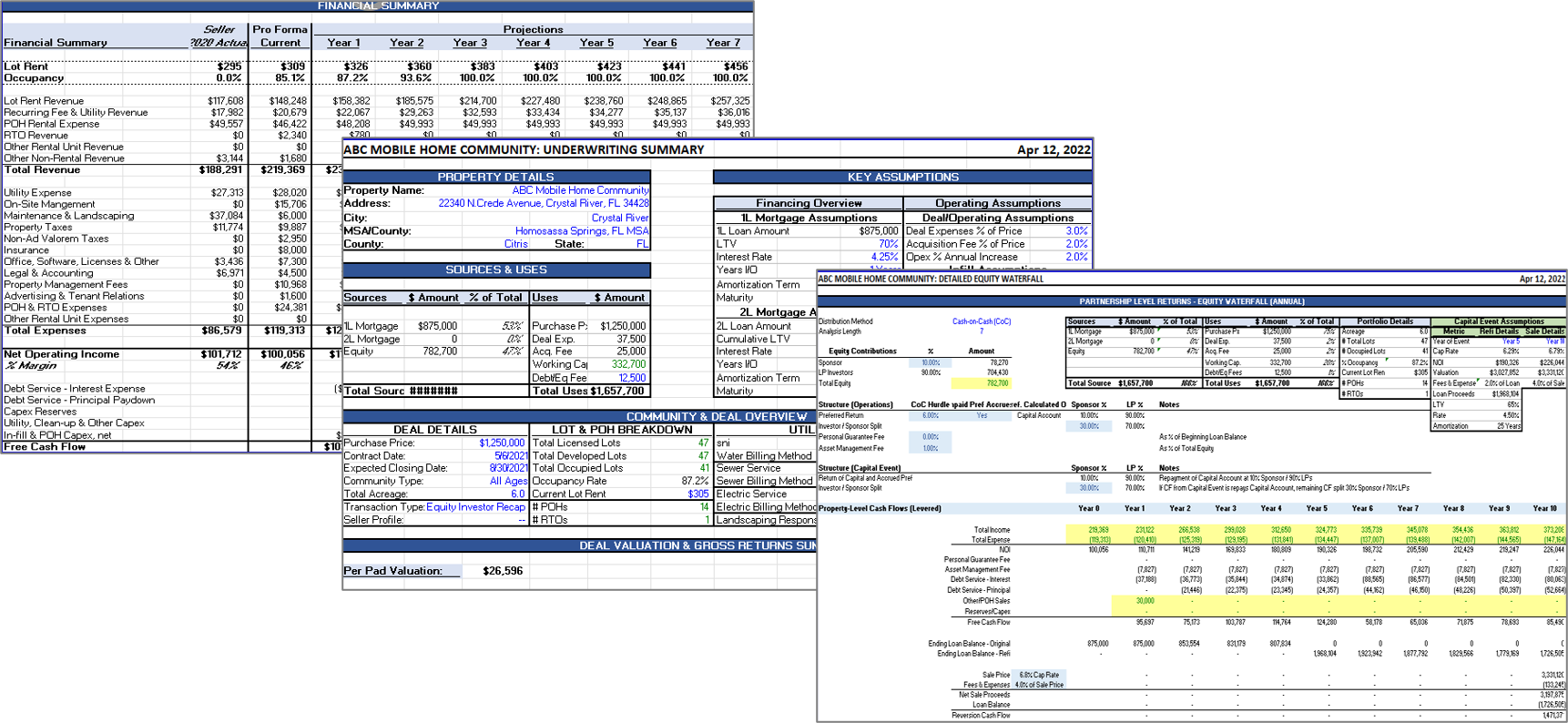

Reach Out to Us NowReal Estate Analytics

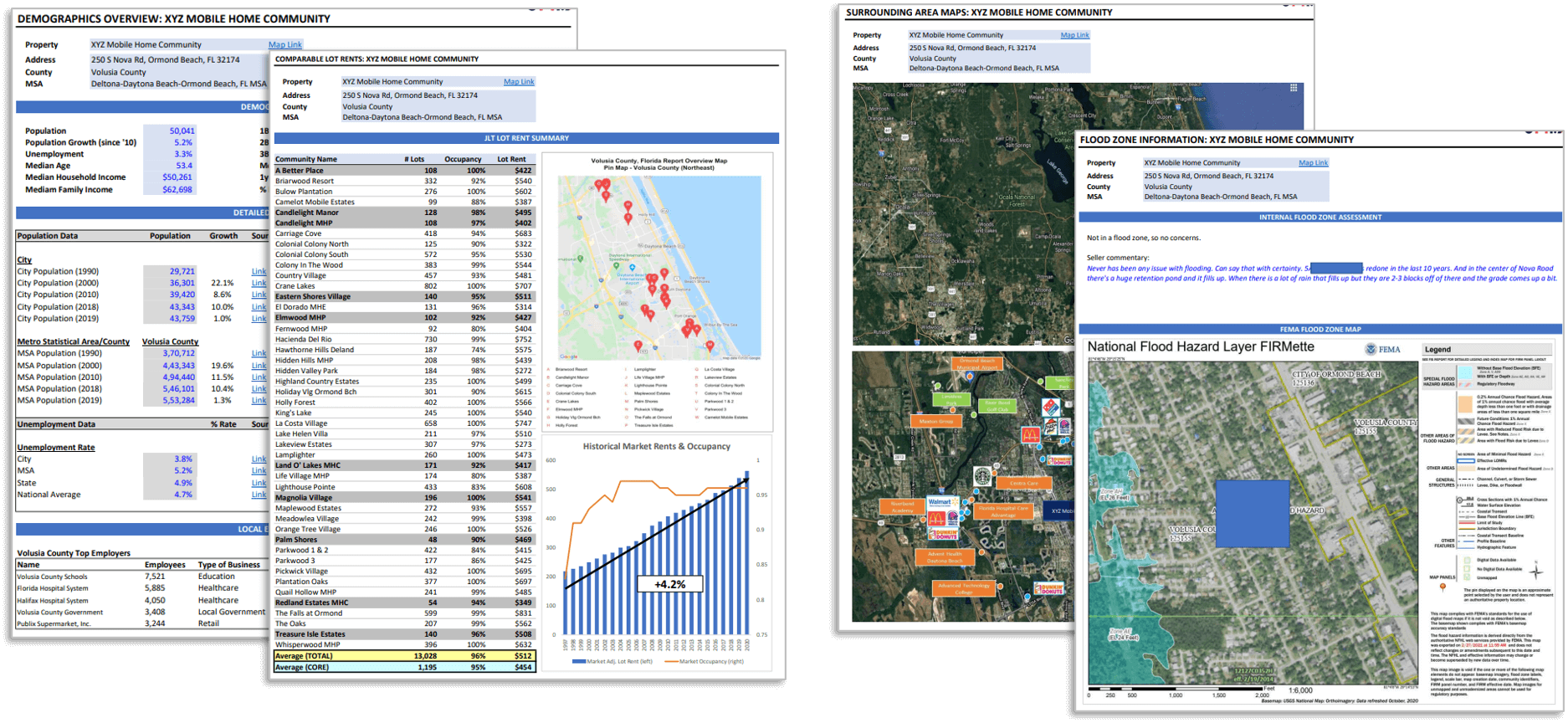

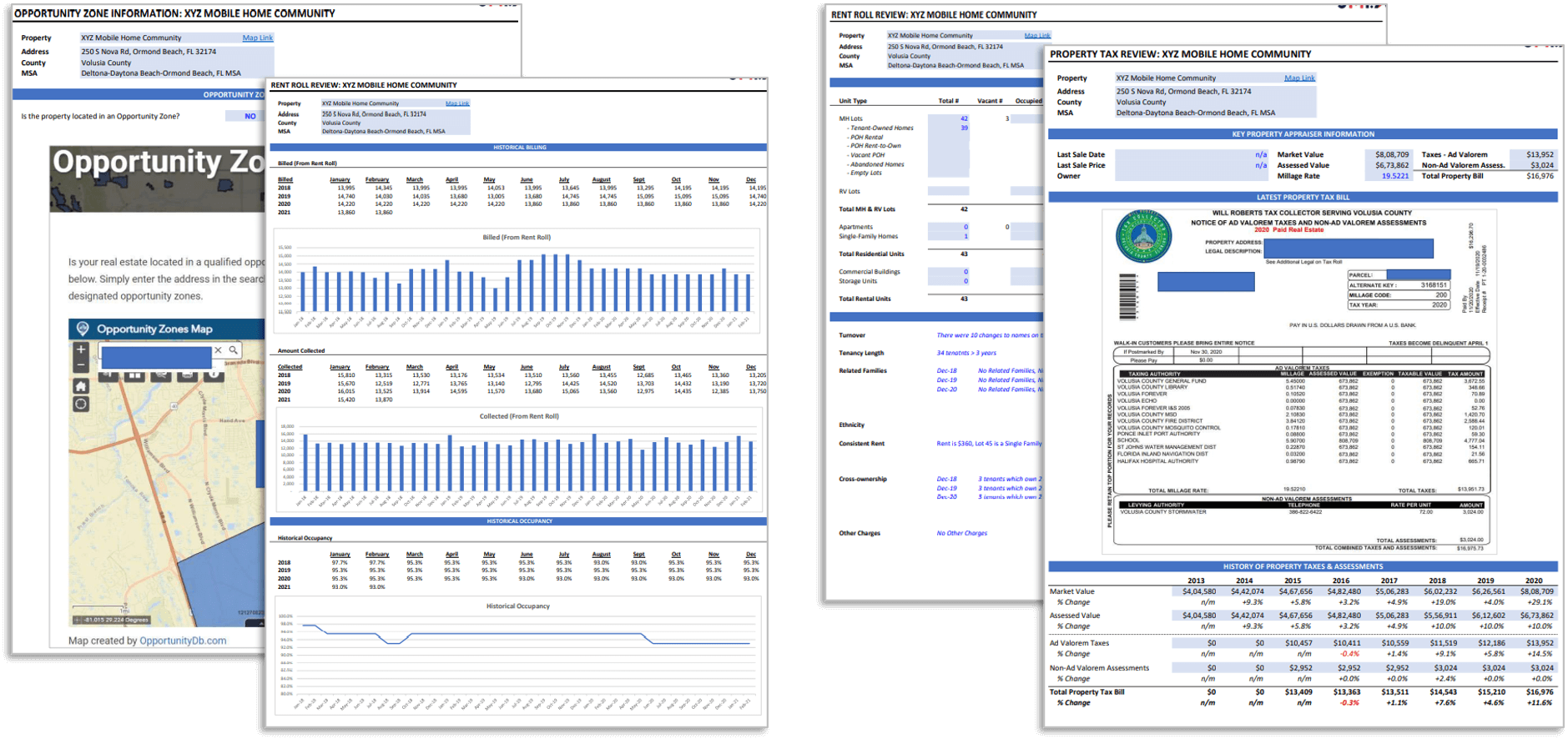

Problem Statement

- How to organize rental data from PDFs and spreadsheets into a centralized database by detecting errors and flagging them before they are input into the database.

- How to use metrics like property reviews, footfalls, and nearby amenities data to find correlations with property prices.

- How to use historical data and trending patterns to forecast rental yield, occupancy rate, and market value.

- How to develop a platform for comparative analysis of different properties.

JMI Implementation

- Assessed the client’s data preparation processes that relied on legacy PDF, spreadsheet, and CSV input formats. Used Bayesian frequency models to detect anomalies and discrepancies in input data.

- Acquired unstructured data from third-party sources like foot traffic, visitors, nearby amenities, and reviews that are likely to be associated with determining the price of the property.

- Analyzed historical data using statistical algorithms and ML methodologies to understand the rental yield, price appreciation, and occupancy rate.

- Developed a sentiment indicator tool and publicly available data (Zillow) and modeled property price and rental value on a one- to ten-year time scale.

- Developed an interactive web platform that delivers comparable analyses using a variety of different user inputs.

Results

- The data accuracy improvements led to a 12% decrease in time spent on manual corrections.

- The client has been able to scale up the client offerings by more than 15% in a six-month timeframe.

For More Information and Details

Reach Out to Us NowA Smart Search Solution Powered by AI

Objective

Our client, one of the top 5 tech companies in the world, wanted to:

- Design a smart search solution to optimize the search for potential candidates from a large pool of profiles. The design solution can retrieve the most appropriate candidates based on their past performance and search query pattern.

- Optimize the search results by using multistep algorithms that will narrow down the results and rank the candidates based on their likelihood of getting hired.

Solution

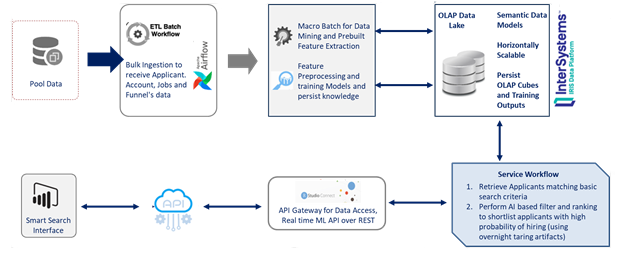

- Designed a solution on top of an applicant 360 data lake and replicated transactional data from the pool.

- Designed micro-batches to extract and curate features that were used to track the past performance of applicants and unique qualifiers such as the applicant’s location, past experiences, background, positivity index from answers provided, past recruitment status, etc.

- Core search engine models were trained on a regular interval (overnight batch), and trained artefacts were stored in the database. The training process used the hired status of the classifier to predict the likelihood of any candidate being shortlisted for any specific job.

- The JMI team also designed the "Search API" to take basic inputs from recruiters and retrieve the matching records. The service used AI runtime to shortlist and rank candidates further based on the probability of hiring within the context of search criteria.

Benefits

- Ensured targeted response by ranking profiles.

- AI-powered search to automate the first level of scrutiny and maximize time-to-value in bulk recruiting lifecycle.

Value Proposition

- The AI-driven “search API “ was able to shortlist applicants with more than 90% accuracy. The solution was tested with historical data points using a wide range of job profiles, funnels and applicants. The robust and scalable design of the solution outperformed the standard keyword and metadata-based search capabilities while offering low latency response.

- The solution helped minimize the time and effort of a recruiter to identify ideal candidates for recruitment and shorten the hiring window of hiring. It was primarily designed to support bulk recruitment initiatives where the recruiters need to qualify, appoint a large number of candidates for multiple positions and/ or locations within the shortest possible timeline.

- The multistep AI-based learning when applied on the validated history of applicants, their interview and job performances helps offer deep insights on potential hires and extends the first level of scrutiny as an intelligent hiring assistant. Such utilities not only boosted productivity significantly but also helped minimize operational cost of the recruiting agencies.

For More Information and Details

Reach Out to Us NowDeal Analysis in Semiconductor sector private equity firm

Situation

- A US-based $5bn private equity asset management firm wanted support for its core investment team in analyzing a deal in the semiconductor industry and provide actionable insights for deal negotiation.

- Expected deliverables were key insights on business performance, future growth potential, regulatory challenges, competitor analysis, key transaction risks and expected return.

JMI Implementation

- Conducted detailed fundamental research on company financials to get insights on revenue growth, cash flows and other key performance indicators.

- Identified that company had not only outpaced the industry growth by 10% in the past 5 years, but also had an above average operating margin of 24%

- Found that the company’s next gen EUV product could extend the coverage of its customer roadmaps by 10-15 years which would help it to increase its market share.

- Identified that the company had been gaining market share for the past three years.

- Analyzed that the company has key risks from its limited number of customers. Any business failure or insolvency of one of their main customers could result in significant credit losses for the company.

- Researched the impact of current regulation on exports and found that the US government could require a license for many high-tech products shipped to China from other countries if US made components constitute more than 25% of the value.

- Based on research and management commentary, JMI found that company did not meet the 25% threshold but the US department might consider lowering the 25% threshold in some cases which could be a key risk in its future growth.

- Correlated the company’s enterprise value and EBITDA with competitors to understand its valuation with operating metrics.

Value Delivered

- Delivered financial model with sensitivity analysis comprising of key business drivers, cost structures, product mix and future growth prospects.

- Computed company’s proposed valuation of 12.5x EV/EBITDA and expected return of c.36% for an investment period of 5 years.

For More Information and Details

Reach Out to Us NowData Driven PE/VC Investing

Situation

The client was a growth equity firm partnering with B2B software companies with a track record of 25+ strategic investments and 19 successful exits. The client wanted JMI to help them improve and streamline their deal-sourcing process. The criteria for identifying investment opportunities were as follows:

- B2B SaaS companies that have secured < $10 million in funding with a 15–125 workforce strength.

- Prospective companies not located along the West Coast.

- Outsourcing, staffing, solutions, consulting, system integrators, resellers, and companies with proprietary hardware are not to be considered.

- The Top management of the company should be based out of North America only.

JMI Implementation

JMI was involved in the end-to-end process of deal sourcing including:

- A custom-web scraping tool was built to extract data from multiple unstructured data sources based on specific criteria such as employee count, funding raised, investors, company description, company geographic location, and company sector.

- The tool filtered the results based on specific criteria such as company brand value, customer sentiment, product portfolio, social media posts, customer reviews, management team and other unstructured data.

- By looking at relevant data patterns and trends, the model conducted early detection of companies with high growth opportunities and decided whether it’s an opportunity worth pursuing or not.

- This was further refined through manual shortlisting by analysts based on investment criteria.

- Clustering analysis was also undertaken from the collected data points to further understand the geographic spread of companies shortlisted based on investment criteria. The analysis revealed that a lot of SaaS start-ups were getting set up in the states of Arizona, Texas, and Michigan.

- The shortlisted companies were added to the client's CRM portal and custom outreach emails were sent to them.

- A deck of short notes for preparation before the client's call with the prospect company management was also shared with the client.

- Promising companies for the future were also flagged, labeled and added to the CRM portal with an alarm to check on their status in 6 months down the line.

Results

The outcomes achieved were the following:

- Increased deal flow by 30%

- Screened over 30,000 companies from different pools of data and shortlisted around 3,000 companies.

- Helped the client save 40% time.

- Helped improve the accuracy of shortlisting and segmentation from 40% to 90% (approximately).

For More Information and Details

Reach Out to Us NowManaging & Growing Portfolio

Situation

- A middle - east based VC firm requested JMI to advise the CEO of the Portfolio Company in making separate models to enable budgeting and evaluating potential investment opportunities.

- JMI was asked to streamline the financial reporting, create a formal budgeting framework, and evaluate the potential of proposed investment opportunities.

JMI Implementation

- Prepared a detailed budget model to highlight the key revenue & cost drivers of business.

- Assisted in the identification of key earnings sensitivity parameters and KPIs.

- Created returns analysis for different types of scenarios.

- Constructed a flexible model with detailed drivers and switches, enabling evaluation of potential projects and investments.

- Conducted review of relevant indicators to ensure that the deal outlay value was quantified, and that capital spending met internal funding criteria.

Value Delivered

- Presented a detailed model layered with drivers and switches that supported budgeting as well as reporting requirements.

- Delivered a customized project evaluation model, enabling review of investment opportunities.

For More Information and Details

Reach Out to Us NowGrowth Strategy

Rationale

- Portfolio consists of 20-25 growth-oriented stocks selected from EM500.

- Stock selection is based on the combination of quantitative methods and qualitative analysis.

- Proprietary programs identify stocks based on strength of the stocks relative to current market and which are in demand and expected to do well due to prevailing economic and sectoral conditions.

- Dynamic Asset Allocation is in-built feature of the small case.

Methodology

- Defining the universe

- Historical back-testing

- Research

- Constituent Screening

- Weighting

- Market Capitalization.

- Management quality and vision.

- Theme exposure, revenues and earnings visibility.

- Rebalance

Top 500 stocks from Emerging Market.

Portfolios are checked for historical outperformance to ensure that only consistently outperforming strategies are selected.

The team does in-depth quantitative research using statistical and fundamental parameters used for constituent screening and constantly manages portfolio risk using max drawdown, skew kurtosis and other volatility parameter.

The research team does individual stock picking after going through company reports and financials and decides on a host of qualitative and quantitative parameters to be considered while screening stocks for the respective strategy.

Following parameters are considered while assigning weights to stocks in this portfolio.

This portfolio has a real-time rebalance schedule. On a daily basis, the research team reviews this portfolio and realign the weights with the selected asset allocation strategy.

Ratio

| Ratios | Portfolio(Growth Strategy) | EM500 |

|---|---|---|

| PE Ratio | 25.38 | 21.93 |

| PB Ratio | 2.38 | 2.45 |

| Dividend Yield(%) | 0.86 | 1.82 |

| Sharpe Ratio | 1.7 | 0.7 |

| Drawdown | 18% | 40% |

Past Performance Comparison with EM500 (1 Year)

Past Performance Comparison with EM500 (3 Years)

For More Information and Details

Reach Out to Us NowCustomized Portfolio Construction and Maintenance

Problem Statement

Our client, a US-based hedge fund, wanted us to construct a portfolio comprising of biotechnology and pharmaceutical companies based in the US with a market cap in the range of USD 500 Mn to 2 Bn and in clinical-stage for COVID-19 Vaccine development.

JMI Implementation

- JMI team collected the information of 100+ US-based biotech and pharma companies and analyzed each company on the basis of parameters like market cap, FDA approval, trial efficacy, and development stage.

- Screened 30 companies with a trial efficacy rate of more than 80% in clinical stage 2.

- JMI team also analyzed the past trend and other KPIs like revenue growth, profitability margin etc. of each company and screened 22 companies that meets the investment strategy.

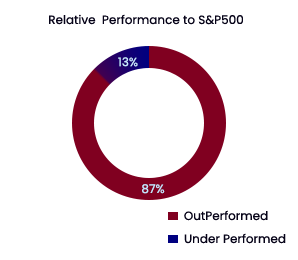

- Back-tested the portfolio with different weights for portfolio optimization to maximize Sharpe ratio or Sortino ratio with less volatility.

- JMI team also tracked the portfolio for a month and identified that the portfolio is trading at a rolling average of 6-11% higher relative to Dow Jones US Pharma Index in the past month.

Selected 100+ US-based Pharma and biotech Companies on key parameter.

Screened 30 companies based on key parameter like clinical stage, efficacy rate etc.

Conducted in-depth research on 30 companies and Selected 22 companies.

Back tested the portfolio with different weights to get optimal portfolio.

Tracked the Portfolio for a month.

Results

- JMI team constructed the optimal portfolio comprising of 22 pharma and biotech companies that are in clinical stage 2 and trial efficacy of more than 80%.

- JMI delivered a Portfolio that is trading at a rolling average of 6-11% higher relative to the DJ Pharma index in the past month.

For More Information and Details

Reach Out to Us NowHedge Fund looking for entry into Emerging Market

Problem Statement

A mid-size US multi-manager hedge fund wanted market research on an emerging market from a risk-reward scenario, market size & depth, liquidity & trading volumes, instruments, trading costs & infrastructure, and taxation & regulations.

JMI Implementation

JMI was involved in conducting initial market research covering all these aspects. Key findings of the project are listed:-

- The market cap of all listed equities in the EM is US$ 3.2tn and is amongst the top-10 traded markets globally. Equity cash market trading volume is US$8.3bn/day and derivative trading volume is US$15bn/day.

- 20mn derivative trades and 15mn cash equities trades are executed on the exchange every day and more than 10000 instruments are available for trading.

- There are more than 3000 offshore FPI funds and 500 onshore funds trading into the EM using various structures, and a fund structure could be setup within 4-6 weeks with a set up cost of US$50,000.

- The EM has tax treaties with different jurisdictions and a favorable offshore structure could be set up. Long-term capital gain taxes are 10% and short-term capital gains taxes are 15%.

- Mean latency of 120.521 microseconds with 360mn order messages per day to the exchange. Co-location and Direct Market Access is available to perform high and mid-frequency trading.

- Average daily volatility of around 3% and annual volatility of 56% across instruments offered ample high and mid-frequency trading opportunities. 10-year index return of 100% with 30% annual volatility offered ample low-frequency opportunities.

JMI Impact

- JMI created a detailed 50-page report for the client gathering local market intelligence.

- After the initial report, JMI assisted the fund with documentation to set up the fund structure.

- The client set up a US $100 mn fund structure from Mauritius.

- The client also set up a 2-member team based out of JMI local office for market research and execution activities.

For More Information and Details

Reach Out to Us NowFinancial Models Buildout & Maintenance

Problem Statement

Our Client, a US-based hedge fund, wanted us to track the Technology, Media and Telecom sector and identify key economic factors that affect the revenue growth, operating cost, cost of capital etc. of portfolio companies and help them in updating the financial model with latest market updates.

JMI Implementation

- JMI team conducted deep research on Technology, Media and Telecom sector and identified the key factors including Government and Regulatory Changes, GDP growth, Inflation and Sectoral revenue growth etc.

- Tracked the market-driven factors like liquidity, momentum and fund flow for each stock and analyzed the co-variance in relation with mean return, industry growth etc.

- Conducted detailed fundamental research and analyzed the financial model of firms such as Intel, Apple, Sony, ASML, Live Nation etc. and figured out key metrics for each company.

- JMI team tracked & maintained the latest financials and key parameters for each company and updated the model accordingly.

- Models were updated on a daily basis and any significant impact was highlighted to the client immediately.

In-depth Study on Sector to identify key metrics

Tracked the market-driven factors like liquidity, momentum and fund flow

Conducted Fundamental Research on Portfolio Company

Keep track on latest financials and key parameter for each company

Updated the model with key parameters on daily basis

Results

- JMI team kept track of the latest financials and identified the key economic and market-driven factors that have an impact on the TMT sector.

- JMI team delivered the updated financial model with the latest market updates on a daily basis.

For More Information and Details

Reach Out to Us NowPerformance Attribution and Analysis

Problem Statement

Our client, a US-based hedge fund, wanted us to analyze the portfolio of stocks and identify the attributes that impact the performance of a portfolio.

JMI Implementation

- JMI team collected the macro-economic data like GDP growth, currency impact, crude oil price and sector trends etc. and analyzed its impact on portfolio companies.

- Conducted fundamental research on portfolio companies to get insights on KPIs and valuation ratios like PE ratios, PB ratios and, EV/EBITDA values.

- Analyzed the technical and pricing attributes like momentum and mean reversion of each stock.

- Analyzed the volatility of each stock based on historical trends.

JMI team Identified that c.13% of portfolio, 13 stocks have shown negative momentum during different time periods over a long time

- Telecom and Logistics sector stocks are underperforming.

- 13 stocks have shown negative momentum at different time period for a long time.

- Identified stocks with ± 2 standard deviation of average mean return.

- Correlated the revenue growth of each company with the industry average and filtered out the companies with ± 1 standard deviation of industry average.

Results

- The JMI team researched on each stock in the portfolio and identified the key economic and fundamental factors that impact the performance of the portfolio.

- JMI identified 19 stocks in portfolio which are underperforming and helped the client in rebalancing the portfolio.

For More Information and Details

Reach Out to Us NowQuantamental Model to Rank Stocks and Bonds

Problem Statement

Our client, a US-based hedge fund, wanted us to rank a large number of stocks and bonds targeted for long-term investments and review the relative performance of the assets to manage risks better.

JMI Implementation

- JMI team accessed a set of 2,000+ stocks and fixed-income instruments from the client.

- JMI developed a customized quantamental model that inherited the fundamental data of each stock, such as quarterly financials, institutional holding patterns, daily returns, etc.

- Leveraged ML model to combine core fundamental analysis with state-of-the-art quantitative techniques to predict the performance of a large number of stocks by comparing their relative performance.

- Investigated through three machine learning models using Feed-Forward Neural Networks (FNN), Random Forests (RF), and Adaptive Neural Fuzzy Inference Systems (ANFIS) for stock prediction based on fundamental analysis.

- The JMI model outperformed the standard ranking model used by the client earlier both in terms of accuracy and turnaround time as the JMI machine learning model was back tested against both long and short investment strategies for equities and fixed income assets over a long time.

Collected 2,000+ stocks from client which they wanted to analyze

Inherited fundamental data of each stock such as financials, shareholding pattern, daily return etc.

Applied JMI unique ML model to predict relative performance of each stock

Investigated through different ML models using FNN, RF and ANFIS

Ranked the stocks and analyzed their relative performance

Results

- JMI ML model ranked 2,000+ stocks based on fundamental analysis using quantamental approach.

- Reduced c.70% turnaround time in analyzing large number of stocks and increased accuracy in performance analysis.

For More Information and Details

Reach Out to Us NowUsing Alternate Data to Analyze US Equity Market

Problem Statement

Our client, a US-based hedge fund, wanted us to analyze a large number of stocks using alternative data.

JMI Implementation

- JMI team accessed the set of 5000+ stocks across three industry verticals.

- Extracted the data of each stock from DTCC which has a repository of data consisting of US Equities trade volumes in context of broader market activity on daily basis.

- Using JMI multilevel model, JMI measured volatilities, risk and returns trends by combining trends of multiple levels of trade concentration for each stock.

- Leveraged JMI model to compare the relative performance trends of industry and sector of the respective stocks.

- JMI deployed the model as a robotics process automation (RPA) to predict key metrics based on the daily feed of the data.

- JMI team filtered out the companies with ± 1 standard deviation in revenue growth relative to industry average.

- JMI team also identified that the 36 companies which are frequent in public news have high volatility and trading volume compared to industry average.

Collected 500+ stocks from client which they wanted to analyze.

Extracted data from DTCC on trading volume in context of market activity.

Measured key parameter like volatility, risk and return trends with trade volume.

Compared Relative Performance trends of industry and sector for each stocks.

Analyzed the pattern and provide insights.

Results

- JMI team deployed a multilevel model to provide insights on volatility, risk and return trends etc. in relation to alternate data for large number of stocks.

- JMI model consistently performed c.32% more efficiently using DTCC data.

For More Information and Details

Reach Out to Us NowReduction of prediction errors

Problem Statement

- How to reduce prediction errors when doing predictions on long-term stock performance.

- How to handle data biases and missing values associated with 20-30 years of multi-stock multi-frequency data.

JMI Implementation

- Assessed client’s Time Series-based model and determined that biases and missing values were not handled optimally - disrupting prediction engines.

- Consolidated uncontrollable number of objective functions containing multiple lagging variables to much simpler objective functions - reducing model complexity and improving efficiency of portfolio returns using dynamic optimization techniques.

- Leveraged proprietary AI runtime to identify and eliminate survivorship, look-ahead, optimization and other biases and helped traders to transform the patterns.

- Using our trained and tested models, JMI helped clients to reduce overfitting because of fewer variables utilized - model performance stabilization.

- This resulted in reduction of false signals generated by earlier system due to missing values and data biases.

Results

- Prediction error reduction by 15% for 9-quarter and 13-quarter forecasts.

- Client can define prediction windows of any duration, not worrying about missing values and bias.

- Client has experienced an improvement of 14% in predicting risks that improved overall performance.

For More Information and Details

Reach Out to Us NowLong Short Strategy

Problem Statement

An investment fund developed a long short index trading strategy to generate additional alpha and reduce the draw down on overall fund performance. However, the actual realized results were significantly different from the back tested results leading to a sub-optimal performance of the fund.

JMI Implementation

Assessed the client’s quant strategy using in-house advanced quant platform and recorded following parameters:

- Sharpe Ratio: 1.75

- Max Drawdown: 8.3%

- Success Ratio: 35%

- Annualized return: 17% over a 20-year high frequency data.

Ran the Strategy on JMI’s proprietary quant platform, across multiple sections of in-sampled and out-sampled data and recorded strategy result dataset which showed varied performance across time frames.

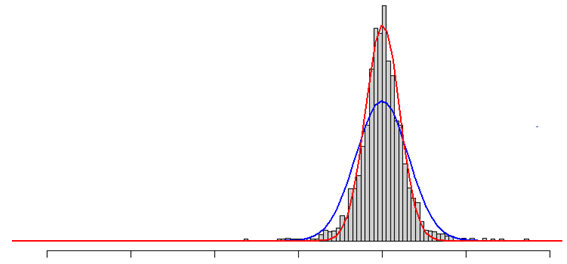

On further statistical analysis across time periods, JMI identified that the back tested result dataset was influenced by high kurtosis (+9.5) and negative skew (-1.7), and this led to high deviation in actual and back tested performance of the long short strategy.

Optimized the long short strategy parameters by using multi-variate regression and statistical modelling.

Added new volatility-based indicator to the strategy which led to a significant improvement in overall strategy and actual results in line with the back tested results.

Results

- The Red line in the graph denotes data set before JMI intervention and blue line after JMI intervention. As shown by the red line in the graph, initially there were more number of trades which resulted in negative outcomes. However, due to a few large positive trades, the back tested results were biased. After the changes, the dataset became positively skewed with normal Kurtosis.

- Kurtosis reduced from +9.5 to +3.5 and skew changed from (-)1.7 to (+)0.8. This led to actual strategy performance in line with back tested results for the fund.

- The long short trading strategy improved and recorded Sharpe Ratio 2.3, Max drawdown -6.2%, Success Ratio 53% and Annualized return 13.7% across time periods.

- Actual strategy performance improved significantly for the client and over the course of the year the client reported that real results were 60% more aligned with the historical back tested results compared to earlier.

For More Information and Details

Reach Out to Us NowLong Only Quant Model

Problem Statement

Long Only Fund wanted to develop quant models for real-time tracking of 1000+ listed stocks and optimize entry/exit of portfolio companies.

JMI Implementation

- Following the client’s primary ideas on the real-time tracking and optimize entry/exit of stocks, our team conducted a detailed research and study.

- Collected 20-years of daily, weekly and monthly exchange data for all the listed samples and systematically applied approx. 30,000 stock-specific corporate action adjustments to streamline the data.

- Performed regression analysis to identify key quant driven price and volume factors for real-time tracking of all 1000+ listed stocks.

- Using JMI’s automated AI/ML platform, JMI back tested different values of the factors and developed a detailed model to track and generate multiple real-time quant signals across the stock universe.

- Developed a connector and linked the model to real-time exchange data feed which would keep models updated in real-time, and generate sound/visual triggers to monitor the markets without any human intervention.

Results

- The client was able to track 1000+ stocks on real-time basis without any human effort which was not possible earlier. The client saved significant man-hours costs compared to earlier manual research methods.

- The client was further able to streamline the entry and exit of stocks using price and volume driven triggers generated by the quant model.

- Optimization added an additional 3% in annual returns to the long only portfolio.

For More Information and Details

Reach Out to Us NowLong Short Strategy used as a Hedge

Problem Statement

Building a long-short trading strategy that could work consistently in US stock markets and that can also be used as a hedge during volatile markets.

JMI Implementation

- The JMI team understood the total long-short exposure requirement from the client and mapped it to the liquidity of various index and stock futures and options. Based on ADTV (Average Daily Trading Value) data, the team proposed to develop an index Long-Short strategy.

- Collected 20 years of tick-by-tick index trading data from the exchanges and sampled the data into 1 hour, 2 hours, daily, and weekly time series.

- Identified key price, volume, and volatility-based quantitative factors using statistical methods, developed a hypothesis, and back-tested it on in-sampled data.

- Using JMI’s automated AI/ML platform, the JMI team ran millions of scenarios based on the values of the factors.

- JMI developed an optimized strategy as per the client’s needs, which showed consistent results across timeframes.

- Re-tested the strategy on out-sampled data and risk and return parameters matched with in-sampled data and validated that.

Results

- The output strategy had a Sharpe ratio of 1.95, a 4% peak-to-trough drawdown, and an 11.5% annualized return on 20 years of data.

- Long-short strategy approved by the fund for actual capital deployment after some tweaks as per the fund’s risk-reward matrix.

- The short arm of the long-short strategy is used by the fund separately as well during times of major events and heightened volatility.

For More Information and Details

Reach Out to Us NowQuantitative Statistical Analysis of US Equity Indices

S&P 500 (SPX): Just 5 %To 7% shy of critical 4150 which may initiate long-term Selling

Description

Created in 1957, the S&P 500 was the first US market cap-weighted stock market index. The index includes 500 leading companies and covers approximately 80% of available market capitalization. Today, it’s the basis of many listed and over-the-counter investment instruments.

Index Characteristics

The index is a capitalization-weighted index and the 10 largest companies in the index account for 28.1% of the market capitalization of the index.

| Number of Constituents | 505 |

| Constituent Market cap (USD Mn) | |

| Mean Total Market Cap | 65,445 |

| Largest Total Market cap | 2,243,557 |

| Smallest Total Market Cap | 3,299 |

| Median Total Market Cap | 25,919 |

| Weight largest Constituent (%) 6.7 | 6.7 |

| Weight Top 10 Constituents (%) | 28.1 |

Sector Breakdown

IT sector companies constitute 27.8% of total market cap followed by consumer discretionary and financials companies. The 10 largest companies in the index, in order of weighting, are Apple Inc., Microsoft Corp., Amazon.com. Facebook Inc, Tesla Inc, Alphabet Inc (class A&C), Berkshire Hathaway, J&J, and JP Morgan Chase & Co.

Historical Trend

Statistical Analysis

Insights on S&P 500

Based on quantitative analysis of last 100 years of S&P 500 data, we found that S&P 500 trades

- 66% of the time 1 SD (standard deviation) above its 10 years mean, 28% of time 2SD above its 10 years mean and only 2% of time 3SD above its 10 years mean.

- Historically SPX touches 3SD after a gap of 10-20 years and it normally results in 30% correction eventually in the next 2-3 years.

- Currently, S&P 500 is trading at around 3,850 which is just 7% shy of 3SD event at 4150. The last instances when the SPX crossed 3SD were in 1988 and 1987 and in both the events, it eventually resulted into 30% correction in the next 2 to 3 years.

- The current SPX set up is unforeseen in the last 20 years and hence not captured empirically by financial research houses.

We believe that SPX may move towards a maximum of 4150 however risk-reward is not much in favor and hence eventfully may correct to 3000 levels in the next 2-3 years.

Risk & Return

The index has highest annualized return of 18.6% in last 3 years with annualized risk of 11.0%.

| Annualized Risk | Annualized Return | |

|---|---|---|

| 3 Years | 18.6% | 11.0% |

| 5 Years | 15.0% | 15.5% |

| 10 Years | 13.5% | 12.8% |

Risk is defined as standard deviation calculated based on total returns using monthly values. All information as on January 30th, 2021.

NASDAQ: Showing similar patterns just before 2000 dotcom burst

Description

The Nasdaq Composite Index measures all Nasdaq domestic and international-based common stocks listed on the Nasdaq Stock Market. The index is a large market cap-weighted index of more than 2,500 stocks, ADRs, and real estate investment trusts. The composition of the Nasdaq composite is heavily weighted towards companies in the Information Technology Sector.

Sector Breakdown

As of December 30th, 2020, the industry weights of the Nasdaq composite Index’s individual securities are Technology at 48.1%, Consumer services at 19.5%, Health Care at 10.1%, Consumer Goods at 8%, Industrials at 5.9% and Financials at 5.4%.

Historical Trend

Statistical Analysis

Insights on Nasdaq

Based on quantitative analysis of the last 35 years Nasdaq data, we found that Nasdaq trades

- 62% of the time 1 SD (standard deviation) above its 10 years mean, 52% of time 2SD above its 10 years mean, 11% of time 3SD above its 10 years mean and only 1% of time 4SD above its 10 years mean.

- Currently, Nasdaq is trading around 13,500 and has crossed 3SD event at 13000 and is 15% shy from 4SD event which is at 15500. Nasdaq touched 4SD only once in its history just before 2000 dotcom crash which resulted into its losing resulted in 83% erosion of value. Nasdaq has crossed 3SD recently only after a gap of 20 years since 2000.

We believe that upside in Nasdaq is limited to maximum 10-15% from here while downside could be very high as it is moving into bubble zone not seen in the recent times.

DOW JONES INDUSTRIAL AVERAGE (DJIA): offers best risk-reward amongst the larger indices

Description

The Dow Jones Industrial Average is a price-weighted measure of 30 US blue chip companies. The index covers all industries except transportation and utilities.

Sector Breakdown

IT sector constitute 22% of its weight followed by 17.9% for healthcare and 16.4% for industrial sectors.

Historical Trend

Statistical Analysis

Insights on DJIA

Based on quantitative analysis of last 30 years, we found that DJI trades

- 66% of time 1 SD (standard deviation) above its 10 years mean, 31% of time 2 SD above its 10 years mean and 0% of the time 3 SD above its 10 years mean.

- Currently, DJI has crossed 30,200 level which is 2 SD above its 10 years mean. Dow has historically been comfortable at 2SD and hence we expect Dow jones to move up further from these levels as 3SD event is 20% away from the current levels.

On comparing DJI index with other indexes, we believe that DJI can offer better risk-reward in the near future compared to NASDAQ, SPX and RUT.

Risk & Return

DJIA has highest annualized return in last 5 years with annualized risk of 15.5%

| Annualized Risk | Annualized Return | |

|---|---|---|

| 3 Years | 18.8% | 6.3% |

| 5 Years | 15.5% | 14.6% |

| 10 Years | 13.6% | 11.6% |

Risk is defined as standard deviation calculated based on total returns using monthly values. All information as on January 30th, 2021

RUSSELL 2000 (RUT): Has moved into unchartered territories

Description

The Russell 2000 Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000 Index is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. As of January 31st , 2021, the weighted average market capitalization for a company in the index is around $3.8 billion, the median market cap is $922 million. The market cap of the largest company in the index is $28.65 billion.

Sector Breakdown

As of December 31st, 2020, the sector with the largest weight in the index is Health Care sector which accounts for 21.1% followed by Industrials and Financials, each account for 15.3%. The smallest contribution is by the energy sector.

Historical Trend

Statistical Analysis

Insights on RUT

Based on quantitative analysis of the last 33 years data, we found that RUT trades

- 79% of time 1 SD (standard deviation) above its 10 years mean, 32% of time 2 SD above its 10 years mean and only 1% of time 3 SD above its 10 years mean.

- Currently, RUT is trading at 2,150 and has crossed 3SD event. Prior to 2021, RUT crossed 3SD event only 2 times in the last 30 years, in 1997 and 2013-14. In both cases RUT fell by 30% in the next 2-3 years.

We believe that there is no major upside left in RUT and risk-reward is not at all in the favor of any long trades in RUT. We expect RUT to fall to 1500 levels in the next 2-3 years.

Risk & Return

Russell 2000 has highest annualized return of 16.5% in last 5 years with annualized risk of c.21%.

| Annualized Risk | Annualized Return | |

|---|---|---|

| 3 Years | 25.3% | 11.1% |

| 5 Years | 20.9% | 16.5% |

| 10 Years | 18.8% | 11.7% |

All information as on January 31st, 2021

Conclusion

- Russell 2000 is into unchartered territories and investors should be cautious.

- Amongst all the 4 indices, DJIA looks the best from risk-reward perspective for the next 3-5 years.

- SPX is just 5-7% shy of the critical 3 Std Deviation event which happened just before 2000 dotcom burst and 1987 Black Monday Crash.

For More Information and Details

Reach Out to Us NowEquity Research Support (Asset Manager)

Situation

A US-based Asset Manager with 20+ years of experience and AUM of over USD2.5bn in the global capital markets reached out to JMI for equity research and valuation model support across multiple sectors.

JMI Implementation

- Deploying resources: JMI offered a comprehensive coverage expansion support for the client through a dedicated team of equity research analysts to chase new investment opportunities.

- Rigorous research: JMI performed fundamental research for in-depth analysis to build a detailed financial model and write investment memos.

- Continuous support: JMI actively supported the portfolio manager to evaluate various new investment opportunities across multiple sectors.

- Attending meetings: JMI team participated in calls with company management, sell-side analysts and industry experts to gain deep insights into the company and industry.

- New ideas: JMI team tracked non-core coverage to identify new investment opportunities

- Deliverables: JMI team developed primers, tearsheets and models along with key assumptions and worked on preparing notes updates for earnings, corporate actions, and news releases.

- Portfolio tracking: JMI actively monitored companies under portfolio coverage and updated investment thesis with the impact event on portfolio entities and update existing models a significant event.

Value Delivered

- Client could accelerate their equity coverage of investment universe by 20+ companies within a year.

- JMI helped the client release significant management bandwidth and helped to focus on active portfolio management while chasing new investment opportunities.

- JMI was as engaged by the company on a retainer basis to work with the asset manager.

For More Information and Details

Reach Out to Us NowSell Side Research Support

Situation

- A renowned Investment Bank based in the US, which offers research, advisory, corporate finance, trading and other financial services was facing a bandwidth constraint for increasing their equity research idea origination and coverage.

- JMI was engaged by the firm to prepare three initiation coverage reports and financial models with detailed assumptions on companies from three different sectors (consumer, autos and chemicals).

JMI Implementation

- Public Data: The initiation coverage reports included scanning the company websites, SEC filings, investor presentations, press releases and conference call transcripts, with an aim to gain deeper insights about background of companies, products and services, business strengths, etc.

- Financial Model: JMI prepared plug & play financial models for a period of ten years (including projections for five years) which enabled us to capture the effects of various industry cycles and seasonality of the company’s businesses.

- Strategy: JMI mapped the companies competitive positioning, growth strategies and forecast capital/operating expenditure.

- Other Aspects: JMI also prepared other aspects of the reports like industry analysis, impact on sustainability, risk assessment, financial overview and company outlook.

- Analysis: JMI prepared driver-based financial forecasts, industry-specific valuation, and scenario and sensitivity analysis.

- Investment Recommendation: JMI worked on the thesis for the investment opportunity.

Value Delivered

- Delivered three 30+ pages initiation coverage reports, detailed financial models, slides and one-pagers on three companies from different sectors.

- JMI helped firm scale up research coverage quickly and initiate new investment opportunities and provided greater flexibility to the client along with the ability to scale quickly on demand and get more face-time with clients and focus on corporate access initiative.

For More Information and Details

Reach Out to Us NowSpecial situations investment analysis

Situation

A Portfolio Manager at a US$5bn event driven fund needed help evaluating a potential special situations investment opportunity. He believed that a leading player in the global manufacturing space was being undervalued (by potentially as much as 50%), as a stand-alone entity when compared to the sum of its parts. JMI was engaged to perform a viability study of the client hypothesis, identify mile markers likely to catalyze a valuation re-rating and develop qualitative and quantitative metrics as well as sensitivities around up/down side scenarios.

JMI Implementation

- Market sizing: By combining proprietary research with client insights and using our subscribed databases, we estimated a TAM for the company.

- Competitor analysis and business model changes: JMI analyzed key players in the industry from the perspective of both a competitor and a potential buyer in a divestiture scenario and also identified a recent pivot to the business model which, while not explicitly a part of the client’s original thesis, could potentially generate similar long term returns if executed optimally.

- Ownership breakdown: JMI started by understanding the ownership structure and how that would impact any potential divestiture decisions.

- Segment wise analysis and valuation: We individually broke down each business segment, benchmarked them to competitors depending on the type of product they produced and estimated their spin-off potential. For each individual segment, we forecasted future growth, came up with comparable companies, and assigned estimated future multiples.

- Mile markers and sensitivity analysis: JMI worked on identifying mile markers like market highs, continued underperformance in certain segments and Industry M&A and also performed analysis which showed asymmetric upside if management executes either opportunity (divestitures or new business model) optimally.

Value Delivered

- JMI analysis found that while the business was being significantly undervalued (30-80%) due to its Holding company structure, the probability of multiple spin-offs, and thus significant value unlock situations, was trending in the wrong direction.

- JMI was able to identify a secular growth opportunity that the company was in a great position to exploit.

For More Information and Details

Reach Out to Us NowFinancial Modelling and Business Valuation – Merger Analysis

Situation

- A US-headquartered IB firm wanted support on valuing a US-based packaged Juice manufacturing company.

- The Project involved doing a merger analysis of two entities followed by valuation across various methodologies.

JMI Implementation

- Understood the business structure of two entities from the management to create a business model.

- Forecasted a 5 year quarterly model with separate a financial statements for each of the two entities and subsequently merged the financials to form a merger model.

- Calculated the synergies and impact on the capital structure of the merger entity.

- JMI team examined that the merger would result in saving operational cost of c.$4M and also bring monopoly in the market.

- Valued the company with DCF method and market based approach including company comparable (EV/EBITDA, EV/Adj. EBITDA and P/E multiples) and precedent transaction.

Value Delivered

- The output involved a financial model with different scenarios (Base, upside and downside), Sensitivity and football field analysis.

- Figured out the post-merger valuation of company at EV/Adj. EBITDA multiple of 4.2x through Football field analysis.

For More Information and Details

Reach Out to Us NowResearch Report

Situation

A US-based IB firm requested for a detailed research report on a public listed US-based telecom company to get an actionable investment ideas followed by

- Industry research: Creating a sector compendiums for identifying macro factors that affect the investment potential of the telecom sector.

- Company research: Performing deep-dive research tasks on company such as fundamental analysis and competitive benchmarking.

JMI Implementation

- Provided high level overview of sector trends, outlook and its key drivers like 5G implementation and mobile phone penetration.

- Conducted detailed fundamental research on company financial report to get insights on revenue growth, cash flows and other KPIs. Also, identified the catalyst and key risk factors with its mitigate for business.

- JMI team identified that the company will grow at c.6% CAGR in next 5 year with its ARPU increasing from 42 USD to 48 USD.

- Provided an insight on competitive landscape and constructed a benchmarking model across key metrics like market share, ARPU, and customer base etc.

Value Delivered

- JMI delivered an actionable insights on its report comprises of sectoral research, company research and competitive landscape.

- JMI team also identified that the stock was trading at attractive valuation of 5.1x EV/EBITDA and 6.8x P/E.

For More Information and Details

Reach Out to Us NowAcquisition of Start-up (Sell-Side)

Situation

Our Client, US headquartered mid - market IB firm was advising a digital lending start-up on its acquisition by a large conglomerate.

JMI Implementation

- JMI team extensively reviewed the lending company from an operational, financial and market perspective.

- Identified the comparable companies with similar asset size and loan portfolio and derived the P/B multiple of comparable companies.

- Figured out the pre-money and post-money valuation at P/B multiple of 2.1x and 3.3x respectively.

- Developed pre-deal presentations including acquisition thesis and investment highlights.

- JMI also supported in investor / buyer search and involved in virtual data room management.

Value Delivered

- JMI helped the client in preparing the strategic presentation for the acquisition of fintech start-up.

- JMI also helped the client in reaching out to the potential buyer.

For More Information and Details

Reach Out to Us NowAcquisition of Payment Company (Buy Side)

Situation

Our Client, US-based IB firm, received a mandate to advise a buy side acquisition of a US-based Payments Company, that was looking for Cross-selling synergies and opportunity to increase its end-customer base.

JMI Implementation

- JMI team identified a list of relevant target companies using an exhaustive screening process involving multiple data sources (such as Capital IQ, Factset, Refinitiv and Pitchbok), industry reports and industry associations.

- Benchmarked shortlisted companies across various key parameters including historical revenue, employee growth, funding rounds and management experience.

- Delivered company profiles of the potential 4 target companies covering key business information, segments and financial details that would help in better target evaluation.

- JMI also helped the client in scheduling the meeting with key management of target companies.

Value Delivered

- JMI team carried out initial screening on key parameters and provided a list of all the shortlisted companies.

- Identified 4 potential growth payment companies based on revenue, subscribers and funding type etc.

For More Information and Details

Reach Out to Us NowSales of underperforming public listed companies

Situation

- Our client is a family office, raised a listed equity portfolio of $250M invested across banking, entertainment, telecom, energy, and construction sector in the GCC region.

- Our client wanted us to evaluate the past performance of each company and its growth prospects. They also wanted us to assist in trade sales of the underperforming companies of portfolio.

JMI Implementation

- Conducted detailed performance analysis on portfolio and found that the invested value of $250M fell 15% in value. However, dividend received during the period provided the portfolio MoIC of 1.24x and XIRR of 2.2% over 12 year of holding period.

- JMI team conducted in-depth analysis of each company and their past dividend pay out. JMI team identified that out of 18 companies, 10 companies had MoIC > 1 and positive IRR. The rest of the 8 companies had a negative return on invested capital.

- Conducted relative performance analysis with global indices. JMI team calculated the MoIC for S&P 500 and FTSE 100 would be 2.5x and 1.8x for duration of 12 years on same invested amount.

- Based on the analysis, JMI recommended the sale of 6 underperforming companies based on past performance and future growth prospects.

- JMI also carried out the liquidity analysis on underperforming companies and identified that one of their investment in the company would take ~50 trading equivalent days for sale on their exchange and two of their companies would take more than 10 days for the stake sell.

- JMI recommended the client to find a strategic buyer for the sale of one company having low liquidity and assisted the client in gradual sale of its stake for remaining 5 companies on stock exchange.

Value Delivered

- JMI conducted deep research on past performance of portfolio companies.

- JMI team recommended the growth prospects on underperforming companies.

- JMI team conducted liquidity analysis for each of its stock.

- JMI team assisted the client in gradual sale of underperforming stocks.

For More Information and Details

Reach Out to Us NowPitchbook Creation

Situation

- An American client was looking to create a sell-side pitchbook to present to one of its clients. This client held some stake in an Energy company and was rumored to be on the verge of disposing of its stake.

- The Project involved creating a sell-side case, a detailed company overview, valuation summary, a macro study of firm’s operational market and generating a buyer universe.

JMI Implementation

- Analyzed Energy sector’s performance, correlation of the firm’s SP with oil price, evolution of broker consensus valuation and trend of daily trading volume as a % of free float of the firm.

- Created a detailed business profile covering business overview, segmental analysis, operational presence, ownership structure, debt maturity profile, detailed financial summary with a focus on fundamental cash flow, sources & uses of funds and future capex plans, among other details.

- Prepared a football field analysis showcasing valuations based on peer comp set, precedent transaction, and analyst consensus to arrive at a range of the Company’s implied valuation.

- Created a couple of pages on the macro trends of its operational markets and Energy sector as well as created mini profiles for potential financial and strategic buyers.

Value Delivered

- Our research suggested that the company, despite being fundamentally sound, was undervalued and price recovery seemed difficult. It would also be difficult for the client to sell its stake in the market directly.

- The output involved 14-15 pages for the client to use in the pitchbook based on the client’s formatting requirements.

For More Information and Details

Reach Out to Us NowPitchbook Support and Financial Modelling

Situation