Our comprehensive suite of value-added services spans the entire private capital markets spectrum, encompassing deal origination, thorough evaluation, and diligent portfolio monitoring, all of which empower investment professionals to stay at the forefront of the industry.

Solution We Offer

Deal Screening

- Identifying Potential Targets

- Preparing Target Profiles

- Target Filtering

- Initial Screening

- Assessing deal viability

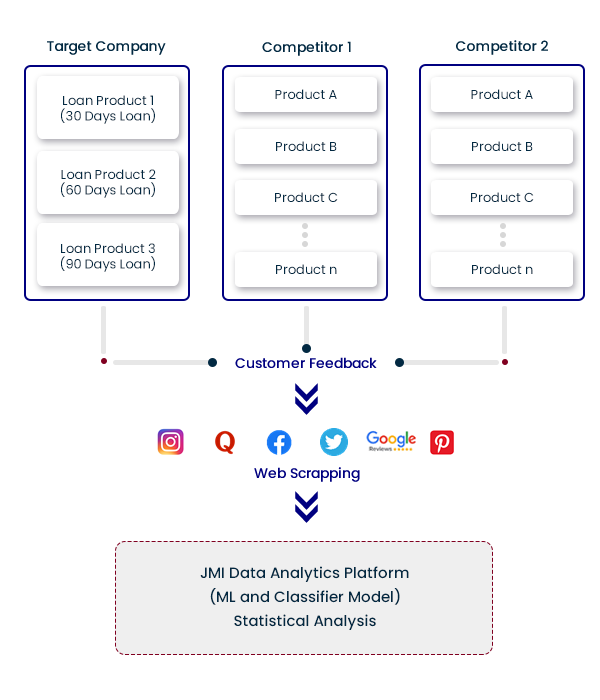

Research & Due Diligence

- Detailed Industry Research and Competitive Landscaping

- Investment Memorandum & Research Reports

- Financial Statement Analysis

- Company Profiling

- Tracking Market Updates and Business Journals

Financial Modeling & Valuation

- Financial Modeling and assumption validation

- Discounted Cash Flow Model

- Leveraged Buyout Model

- Operational Modeling

- Relative Valuation

- Precedent Transaction Analysis

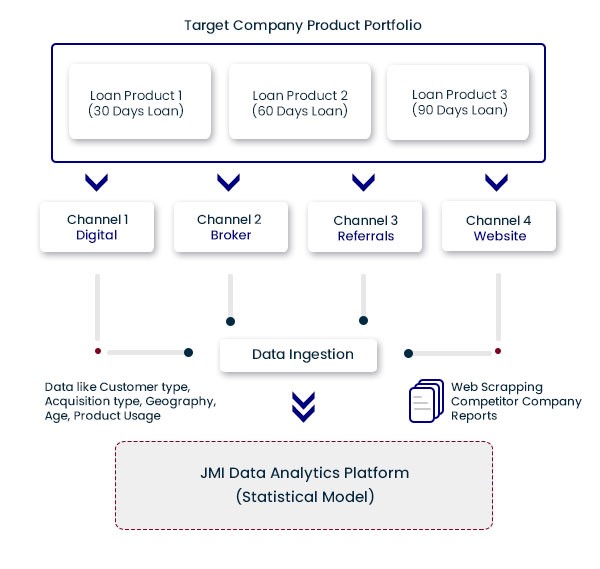

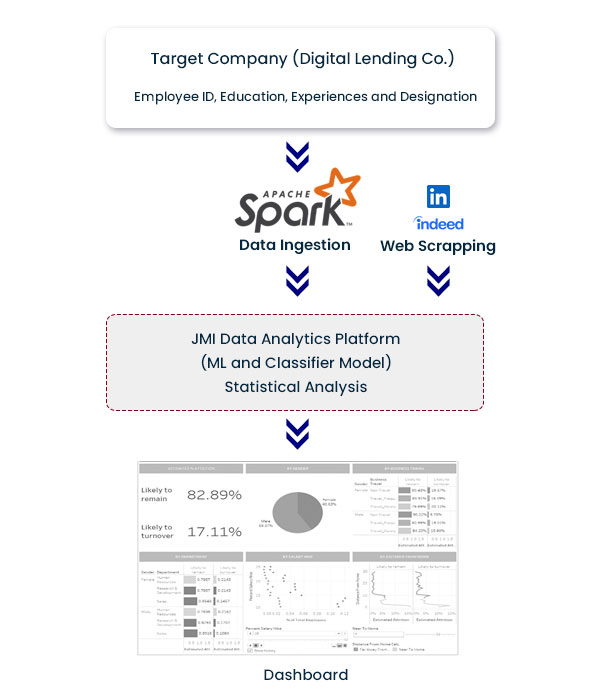

Portfolio Monitoring

- Tracking KPIs

- Portfolio benchmarking

- Portfolio valuation – buildout and quarterly updates

- Dashboarding and Reporting