Global Financial & Investment Research

Providing analytical support to financial firms and corporates

2000+Employees

Across Global offices with Corporate HQ in New York City

1997Established

20+ years of track record

400+Clients Served

In US, Europe and Asia including Fortune 500

$2Billion Transactions Supported

Globally across multiple sectors

Service Offerings

Investment Banking

We are working with investment banking firms to help improve productivity, reduce costs, and become more agile. Supporting them with CIMs, transaction research, financial modeling & valuations, due diligence, and building pitch decks.

Learn MorePrivate Equity

Our comprehensive suite of value-added services spans the entire private capital markets spectrum, encompassing deal origination, thorough evaluation, and diligent portfolio monitoring, all of which empower investment professionals to stay at the forefront of the industry.

Learn MoreHedge Funds

We provide support to hedge funds by offering specialized services that enhance operational efficiency and strategic decision-making. These services include comprehensive risk analysis, market research, and financial modeling, enabling hedge funds to make informed investment decisions.

Learn MoreVenture Capital

JMI play a pivotal role in supporting venture capital firms by offering specialized services such as market research, deal sourcing, financial modeling, due diligence, valuation, and portfolio monitoring. Our expertise enables VCs to make informed investment decisions, identify promising opportunities, and optimize the performance of their portfolios.

Learn MoreFixed Income & Credit Research

Our comprehensive suite of value-added services by leveraging expertise in credit analysis, risk management, and strategic investment to fuel growth and maximize returns to empower your financial endeavours.

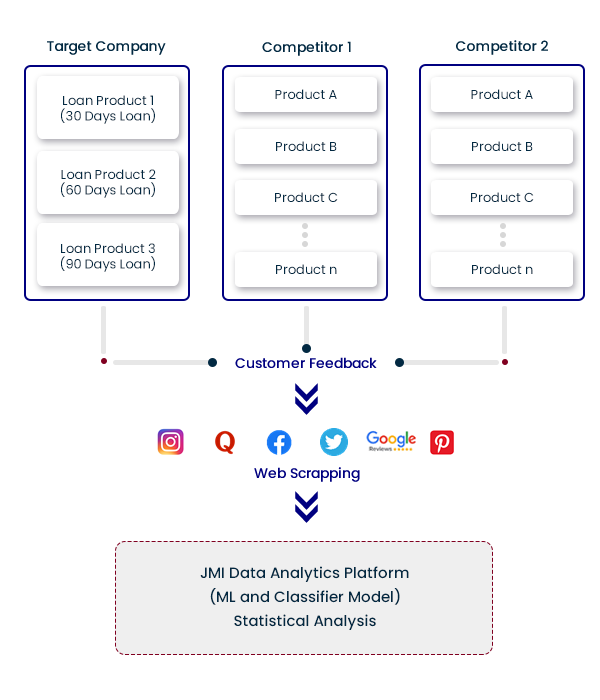

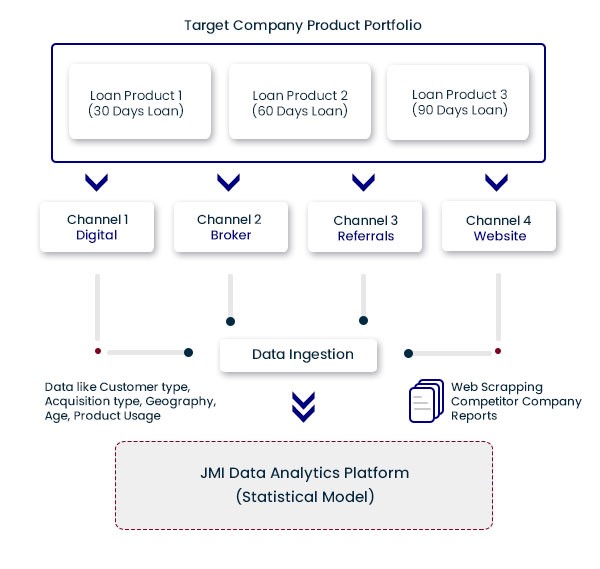

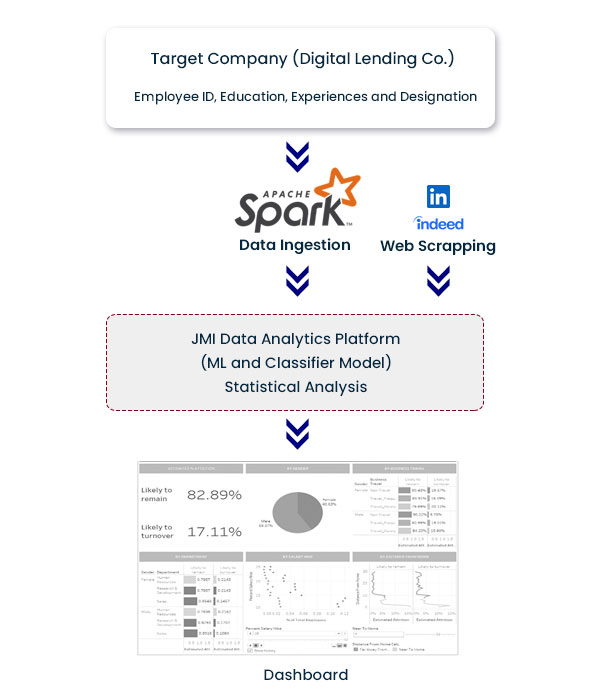

Learn MoreData Analytics

We help firms navigate in today's world of complex data. JMI provides custom-made solutions by leveraging our AI, ML, NLP, and Visualization Expertise.

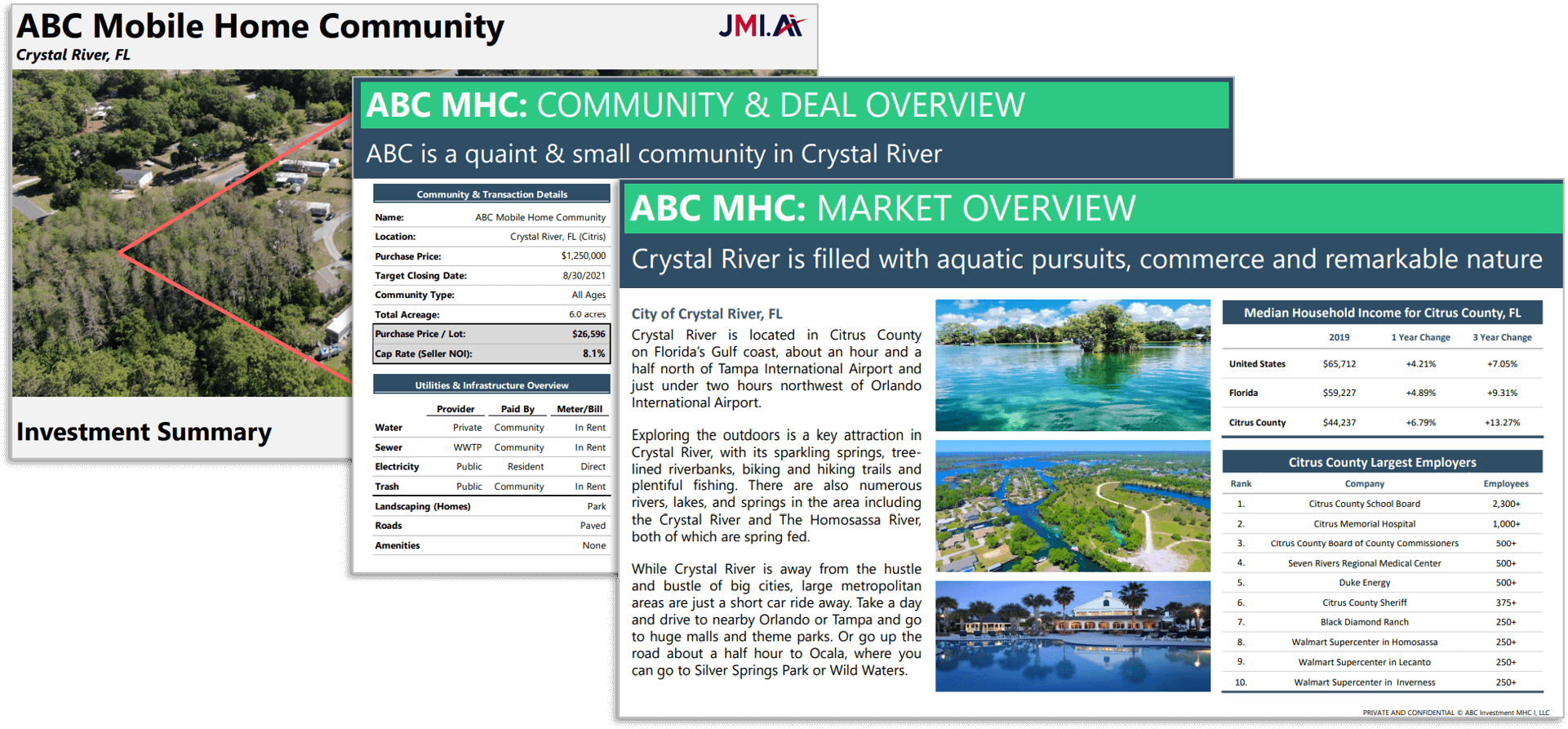

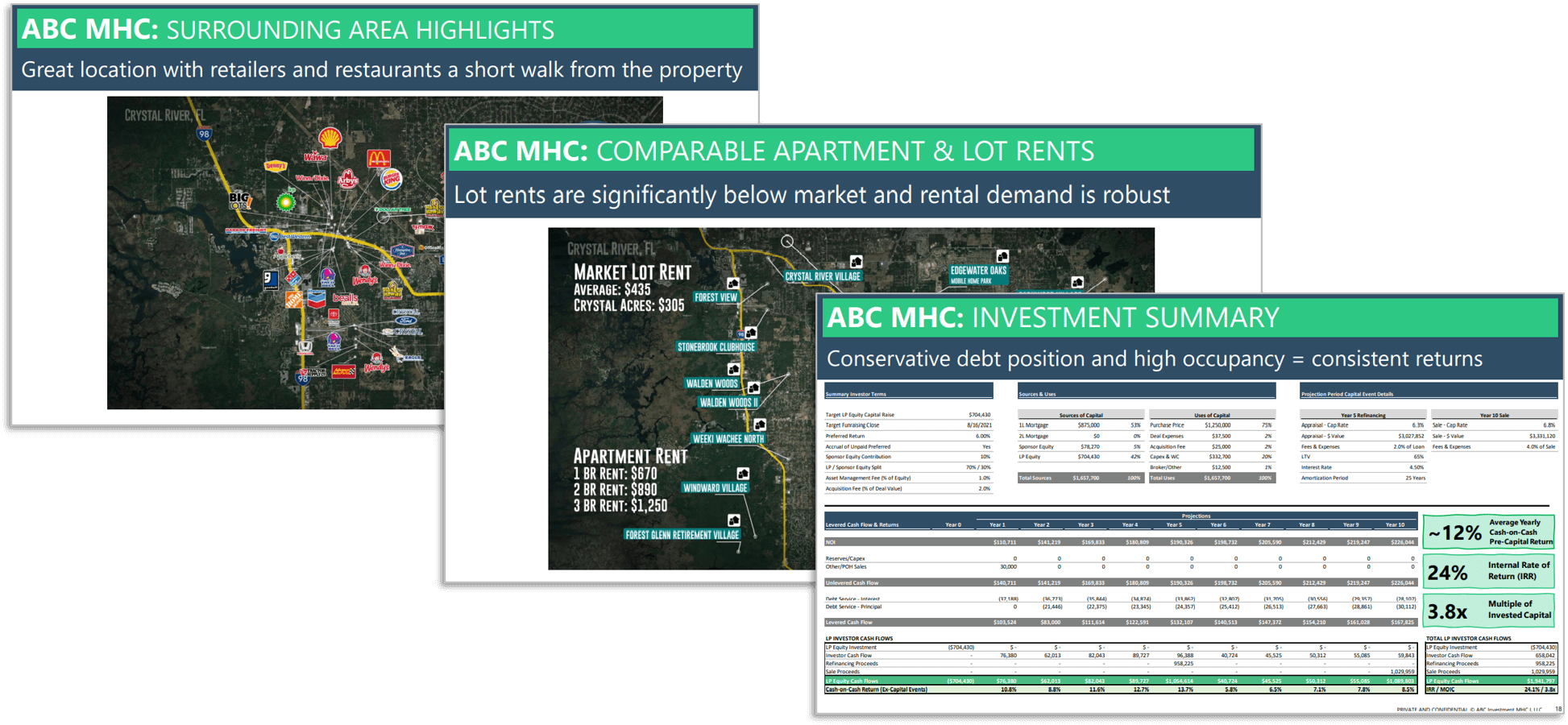

Learn MoreReal Estate Investments

JMI supports real estate funds by offering end-to-end services. These include identifying lucrative investment opportunities through extensive deal sourcing, conducting thorough due diligence to assess risk and potential returns, and managing portfolios for optimal performance. Additionally, we provide expertise in market research and analysis, aiding funds in making informed decisions in the dynamic real estate landscape.

Learn MoreFamily Offices

We specialize in tailored financial solutions designed specifically for family offices, supporting the preservation and growth of generational wealth. Our expertise spans administrative services, asset management, corporate finance, and regulatory compliance, catering to the diverse needs of family offices.

Learn MoreView Our Insights

Get a more Comprehensive View with Our Insights