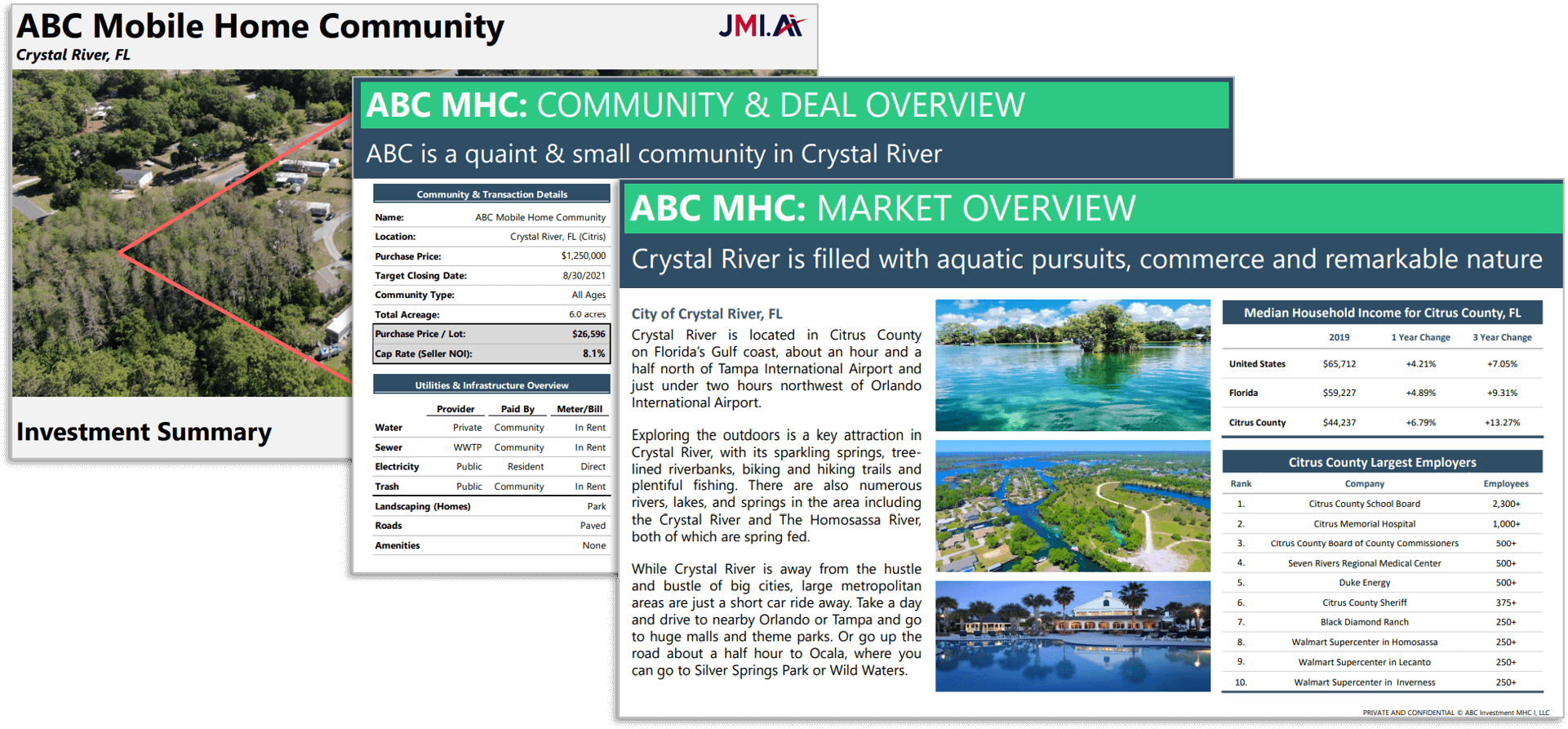

JMI supports real estate funds by offering end-to-end services. These include identifying lucrative investment opportunities through extensive deal sourcing, conducting thorough due diligence to assess risk and potential returns, and managing portfolios for optimal performance. Additionally, we provide expertise in market research and analysis, aiding funds in making informed decisions in the dynamic real estate landscape.

Our Support

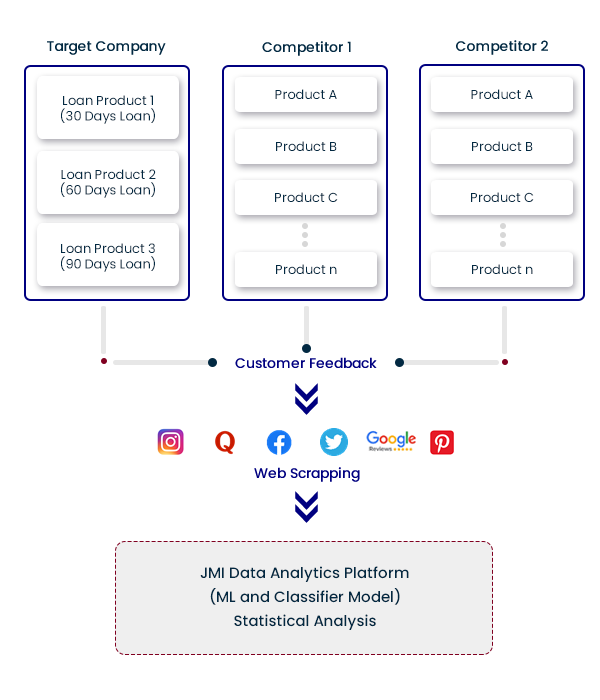

Market Research

Conduct in-depth studies on market landscapes, growth expectations, drives and price analysis

- Market Analysis

- Demand Supply Analysis

- Area mapping and surrounding area highlights

- Rental yield analysis

- Comparable real estate assets

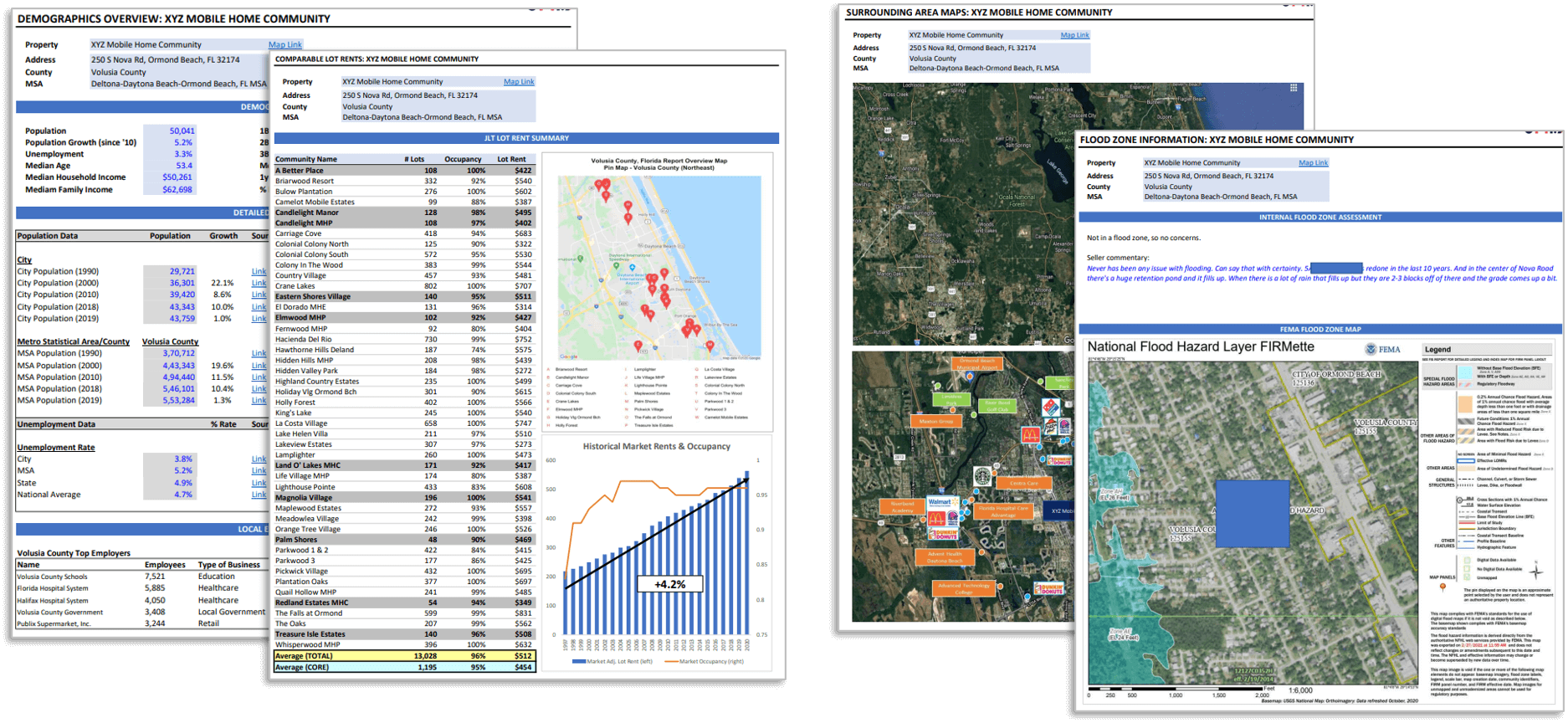

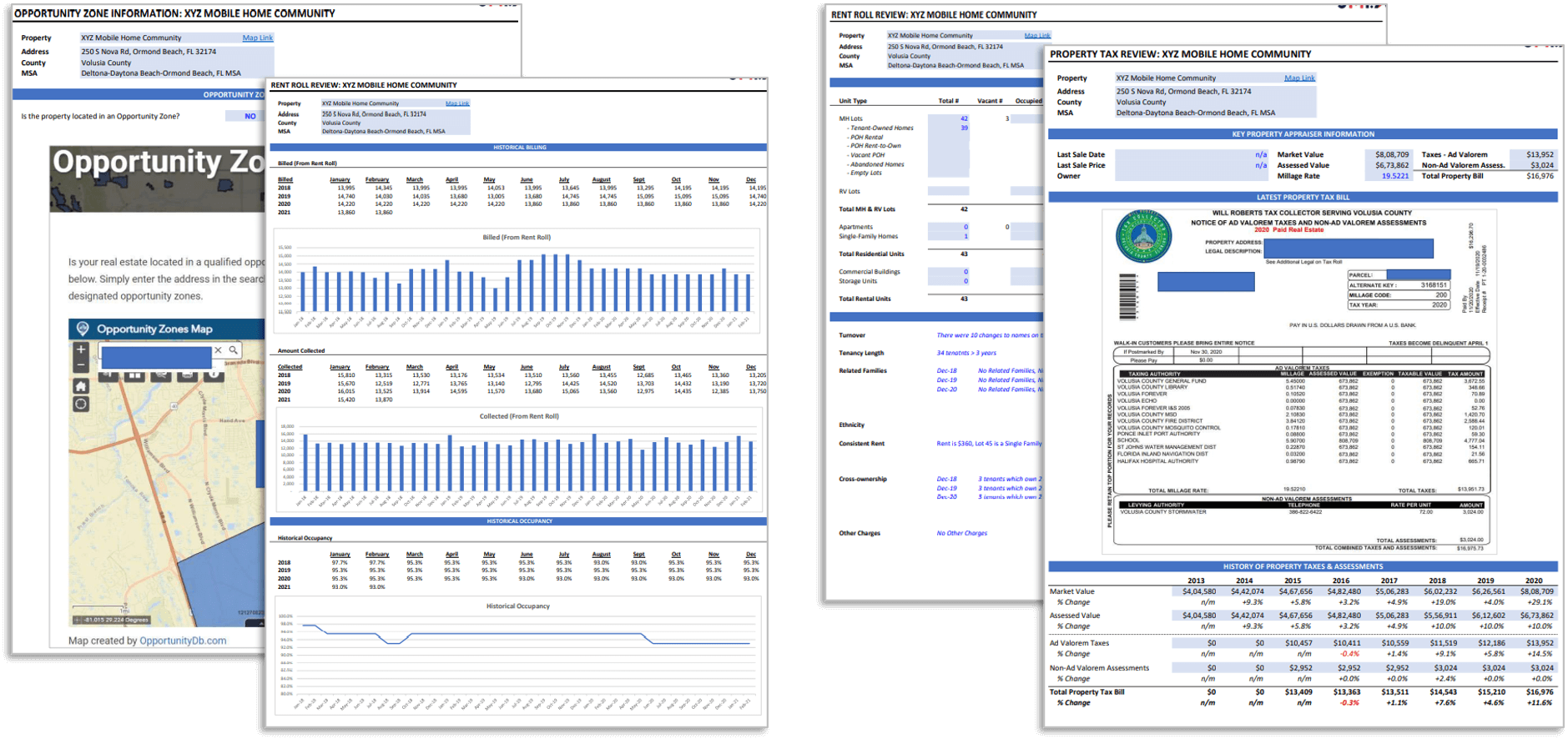

Due Diligence / Benchmarking

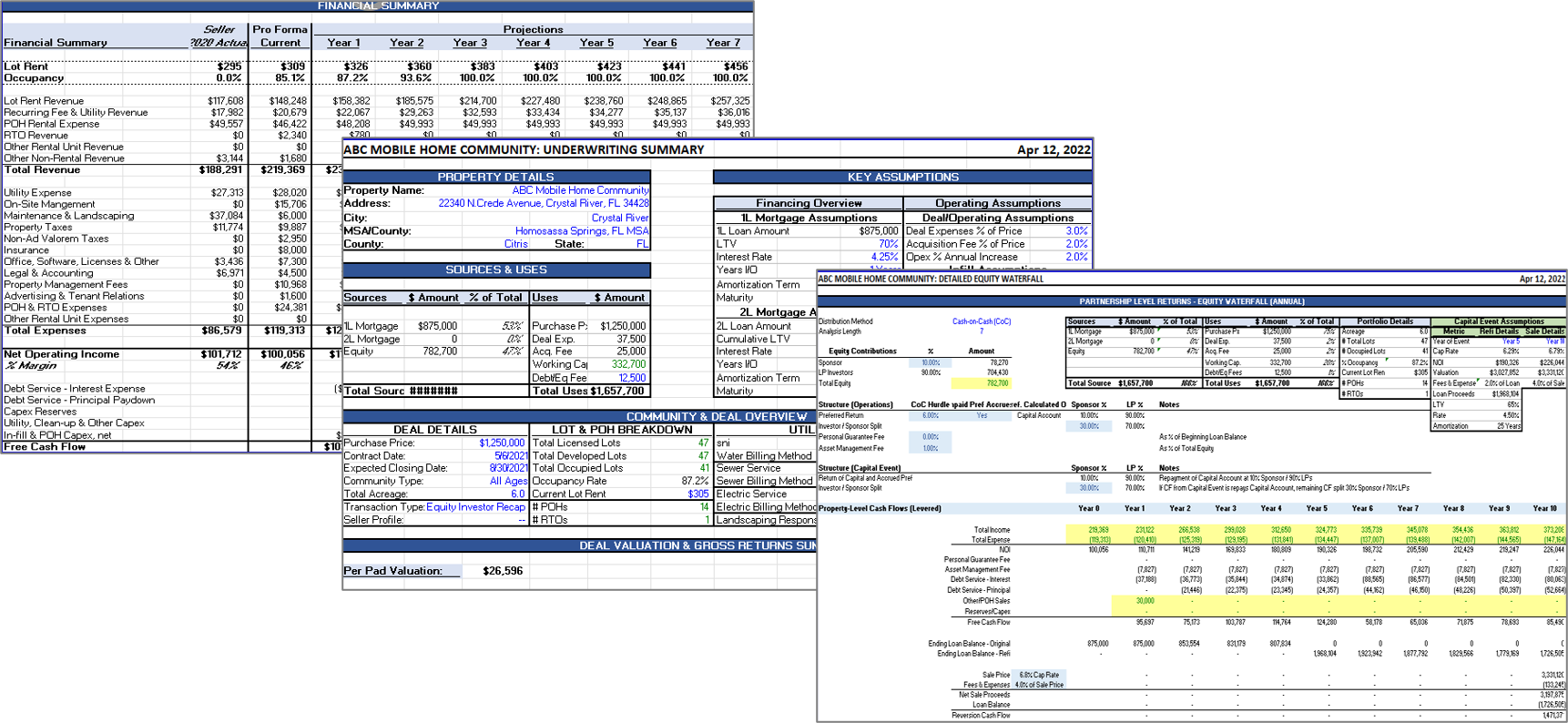

- Financial Due Diligence

- Operational Due Diligence

- Market Assessment

- Validating Assumptions

- Benchmarking

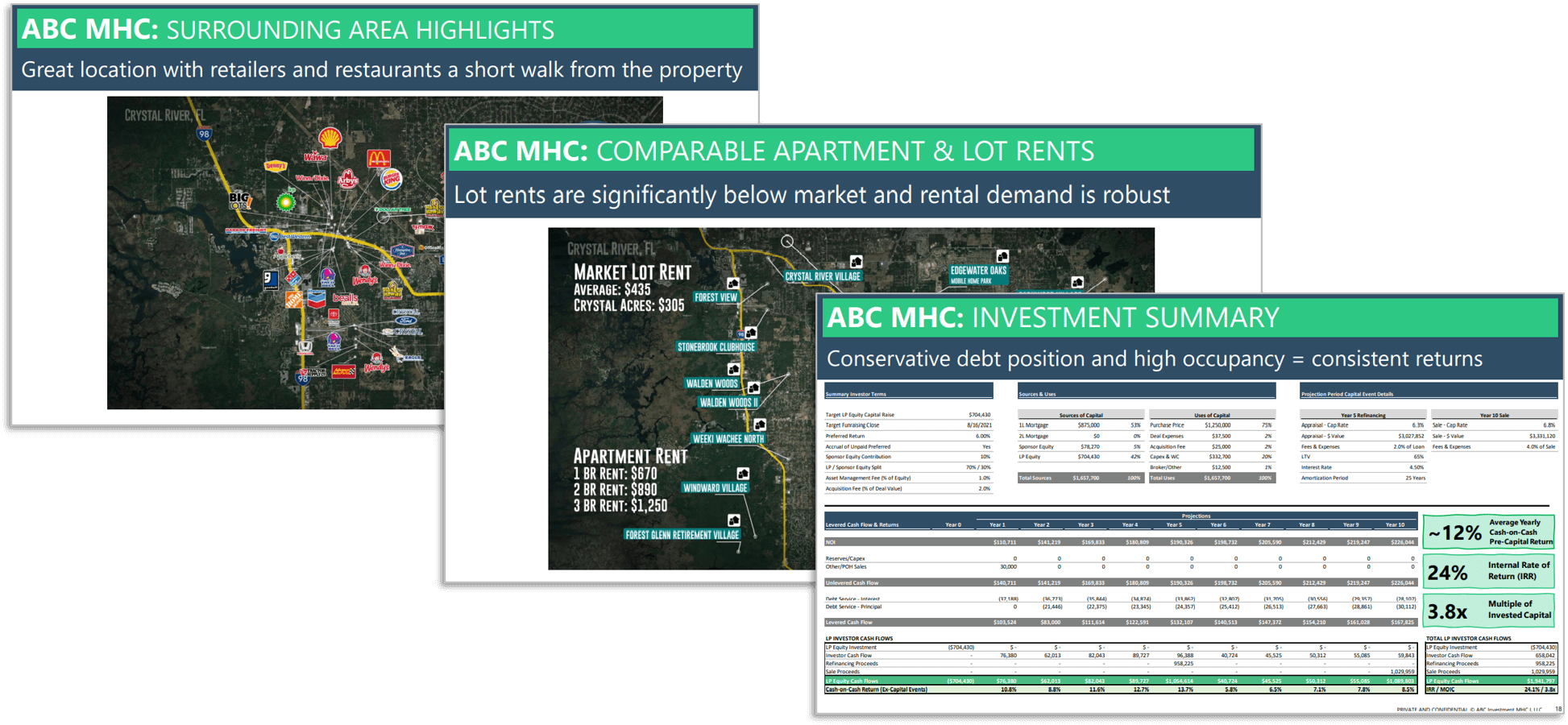

Financial Modeling

- LBO and Merger Models

- Waterfall distribution models

- Cash flow analysis

- Leverage analysis

- Value uplift analysis

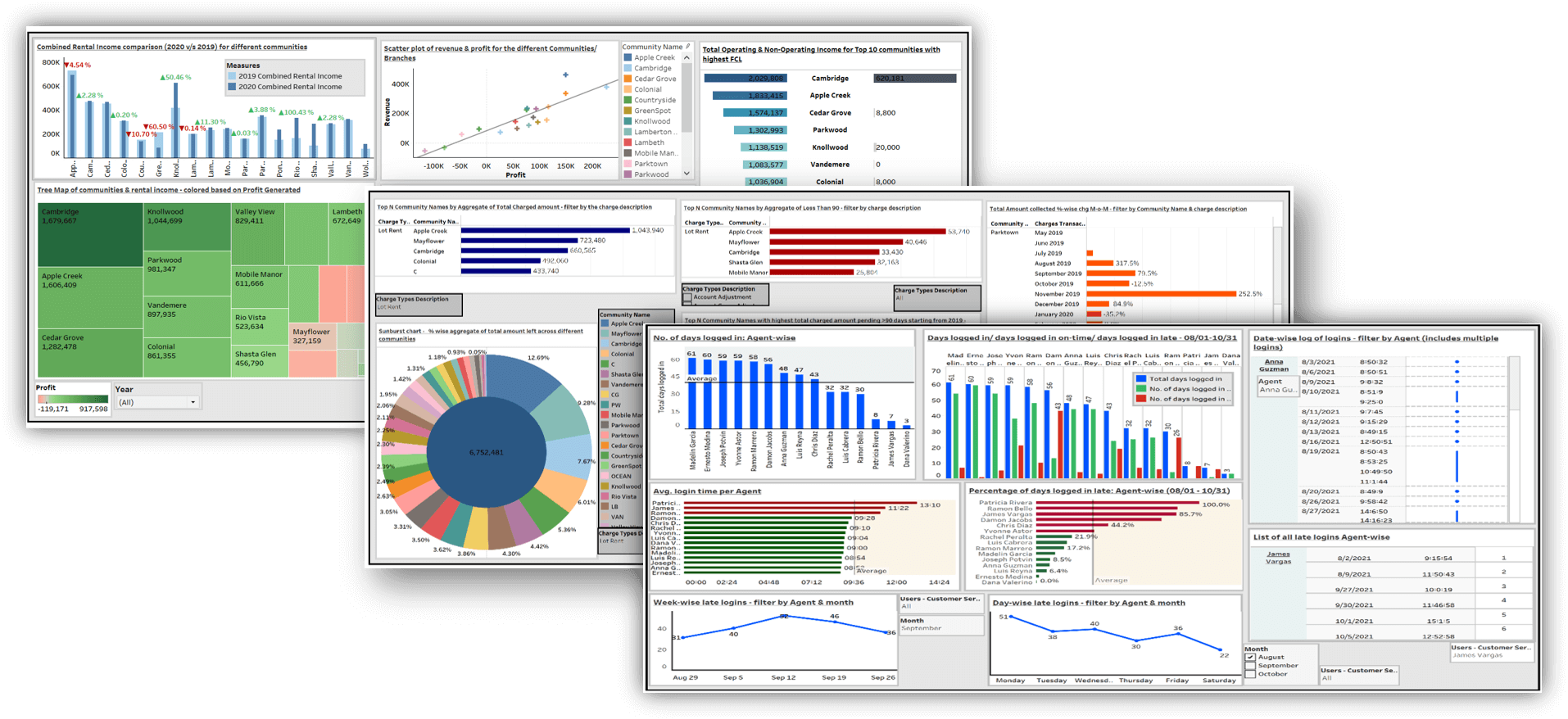

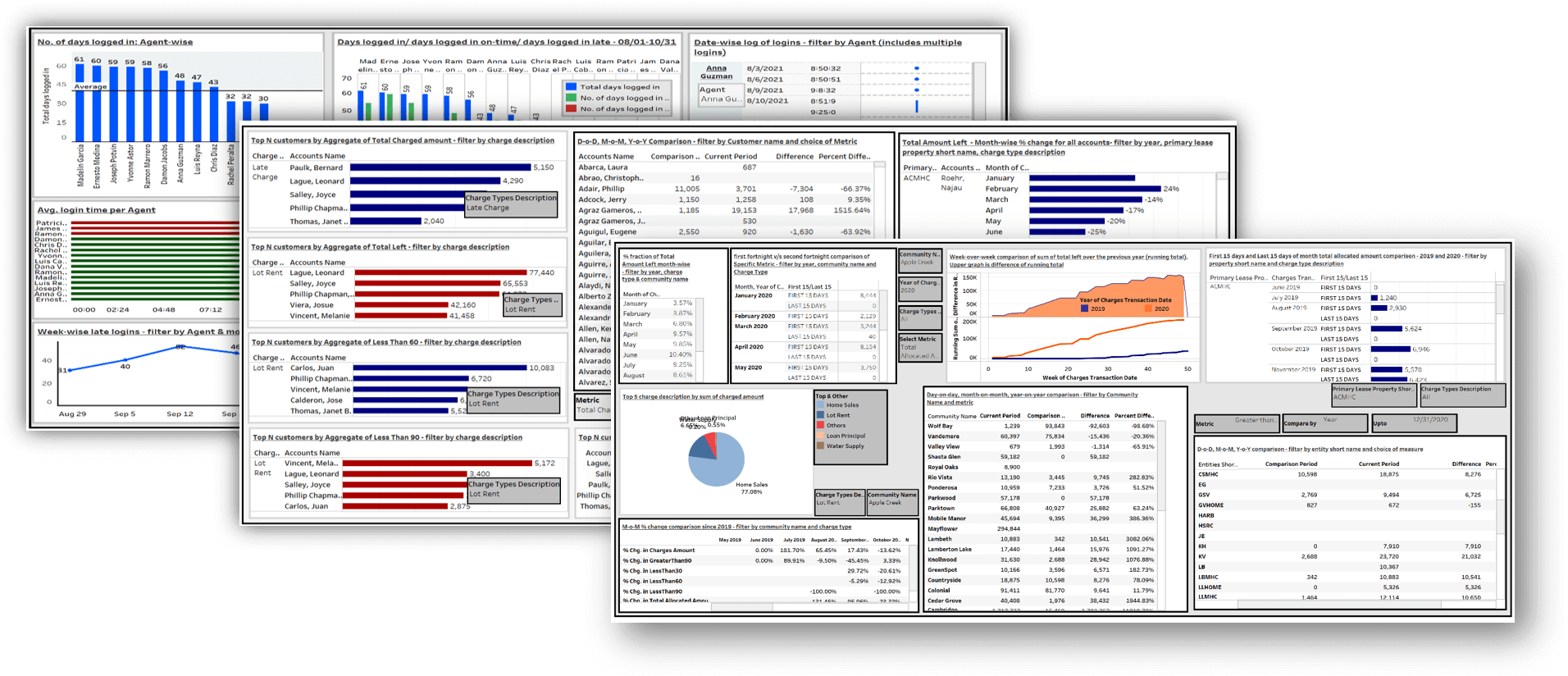

Dashboard & Analytics

- Portfolio Monitoring

- Dashboarding

- Operational & Financial KPIs

- Reporting