Problem Statement

An investment fund developed a long short index trading strategy to generate additional alpha and reduce the draw down on overall fund performance. However, the actual realized results were significantly different from the back tested results leading to a sub-optimal performance of the fund.

JMI Implementation

Assessed the client’s quant strategy using in-house advanced quant platform and recorded following parameters:

- Sharpe Ratio: 1.75

- Max Drawdown: 8.3%

- Success Ratio: 35%

- Annualized return: 17% over a 20-year high frequency data

Ran the Strategy on JMI’s proprietary quant platform, across multiple sections of in-sampled and out-sampled data and recorded strategy result dataset which showed varied performance across time frames.

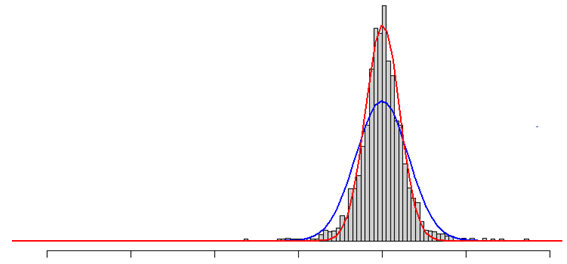

On further statistical analysis across time periods, JMI identified that the back tested result dataset was influenced by high kurtosis (+9.5) and negative skew (-1.7), and this led to high deviation in actual and back tested performance of the long short strategy.

Optimized the long short strategy parameters by using multi-variate regression and statistical modelling.

Added new volatility-based indicator to the strategy which led to a significant improvement in overall strategy and actual results in line with the back tested results.

Results

- The Red line in the graph denotes data set before JMI intervention and blue line after JMI intervention. As shown by the red line in the graph, initially there were more number of trades which resulted in negative outcomes. However, due to a few large positive trades, the back tested results were biased. After the changes, the dataset became positively skewed with normal Kurtosis.

- Kurtosis reduced from +9.5 to +3.5 and skew changed from (-)1.7 to (+)0.8. This led to actual strategy performance in line with back tested results for the fund.

- The long short trading strategy improved and recorded Sharpe Ratio 2.3, Max drawdown -6.2%, Success Ratio 53% and Annualized return 13.7% across time periods.

- Actual strategy performance improved significantly for the client and over the course of the year the client reported that real results were 60% more aligned with the historical back tested results compared to earlier.